July 22, 2021

Medical Schemes Administrator and Managed Care Study – 2021

Established in 1992, NMG Consulting is a multinational specialist consultancy focused on the insurance, reinsurance, wealth and…

Medical schemes generated excess reserves during the pandemic, most intending to return these to members in future years. The approach taken to giving back by individual medical schemes could significantly impact their near-term competitiveness and sustainability.

Most medical schemes generated large surpluses in 2020 and 2021, arising initially from the cancellation of planned procedures and thereafter from a general reluctance of members (and especially those over 50) to seek care during the pandemic. The resulting operating surpluses significantly strengthened the reserves (and solvency positions) of nearly all medical schemes. For some schemes, the strengthening exceeded 15% of annual contributions, being highly significant in comparison to the statutory minimum requirement of 25% of annual contributions.

During the pandemic, many medical scheme members experienced significant financial pressures due to a combination of the weakened economy, loss of income during lockdown as well as job losses. In response, focused on member needs, schemes generally provided relief in the form of lowered contributions during the 2021/2022 pricing cycles.

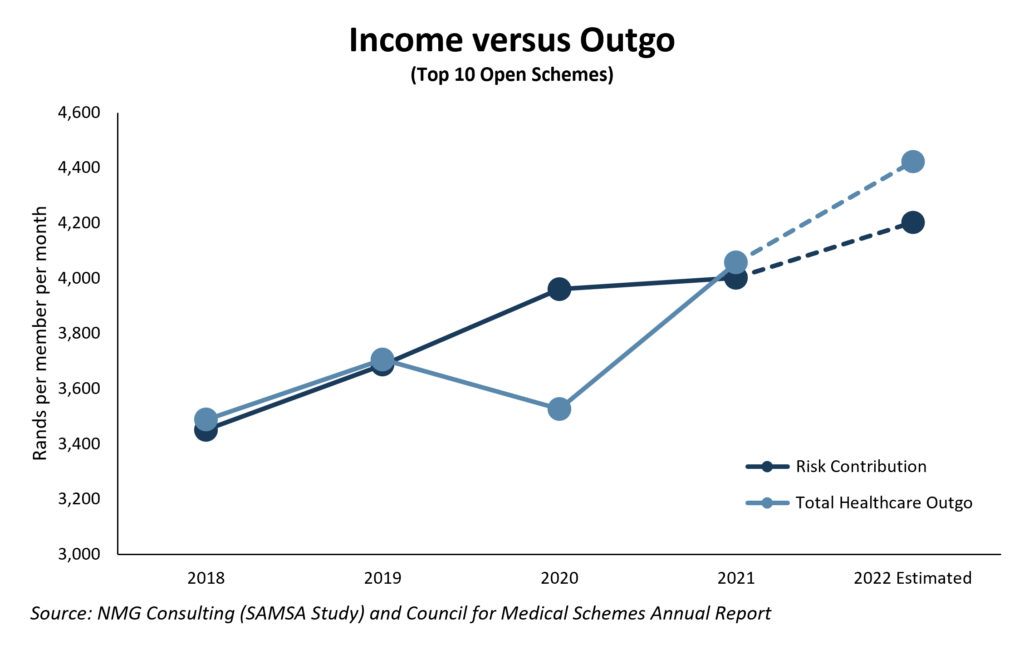

At the conclusion of the pricing review process for 2021/22, scheme executives indicated (as part of an annual NMG Study) that expectations for increases in healthcare spending (9.5%) exceeded those priced into contributions (4.5%) by a full 5%. Heightening its significance, this anticipated increase in healthcare outgo was with reference to a pre-Covid baseline, rather than the depressed claiming levels seen during the pandemic.

Exhibit 1: Planning to give back

Planned risk contribution income was anticipated to fall short of projected healthcare costs (including managed care costs) by as much as 5%, assuming 2022 claims patterns reflect pre-Covid experience. The shortfall equates to >R200 per principal member per month, averaged over the largest ten open medical schemes

Giving back 5% of contributions when reserves have strengthened by a greater extent may sound logical and straightforward, but it turns out this is not without significant commercial risk:

Example: abcMed (For illustrative purposes only)

abcMed’s average contribution should have been set at R4,000 (per principal member per month), but Trustees chose to maintain contributions at a level of 5% below that at R3,800 (mostly unchanged from a year before).

Twelve months later, contributions required an adjustment for medical CPI (typically, +3% above general CPI) as well as a rise in utilisation, totalling 9%. The required average contribution is therefore R4,360 per month, being nearly 15% above the price currently paid by members (ie before increases are implemented).

Customers no longer remembered the original reference price (R4,000 per month), and pushed back against the 15% increase.

abcMed, with a relatively weak value proposition and being vulnerable to small membership losses, struggled to push through the full increase. Rather, it accepted the level of under-pricing, the associated operating deficit and the weakening of its solvency position, postponing the increase to the next repricing date when it (optimistically) hoped it would be in a stronger position to insist on a sustainable level.

There were numerous instances of where schemes addressed short-term affordability issues with approaches other than single-year contribution reductions:

During the pandemic, schemes that implemented contribution increases closer to medical CPI, should have greater flexibility in navigating their way back to sustainability. In contrast, those which passed the increases at the lower end of the range face a trickier transition.

In most cases a multi-year approach of small increments above medical CPI will prove optimal, dependent on successfully ‘resetting’ member expectations of reasonable increase levels, robust forecast modelling and stress testing. NMG analyses indicate that 15% excess reserves are required to support a deficit of 5% of contributions for a single year.

Starting with the 2023 pricing process, Trustees will have to use excess reserves judiciously to balance the competing objectives of assisting members with economic challenges while keeping their schemes sustainable.