May 25, 2022

ESG leadership and net zero

In this Citylogue, we discuss the opportunity for asset managers to turn net zero commitments into ESG...

Over the last 18 months, ESG has become a lightning rod — challenged politically, questioned commercially, and diluted by overuse. In response, some asset owners have reclassified assets. A few managers have stepped back from public commitments. And more than a few headlines have declared ESG’s demise. But our most recent Study suggests something else entirely.

NMG’s annual Global ESG Study — based on in-depth interviews with 160 leading asset owners managing over US$4 trillion in assets — shows that ESG is evolving, not retreating. Asset owners are becoming more selective, more strategic, and more aligned to outcomes that matter. And expectations for managers have followed.

Among high-ESG-maturity investors, active ownership is now considered the most effective approach to achieving climate goals. Investors want influence, not distance.

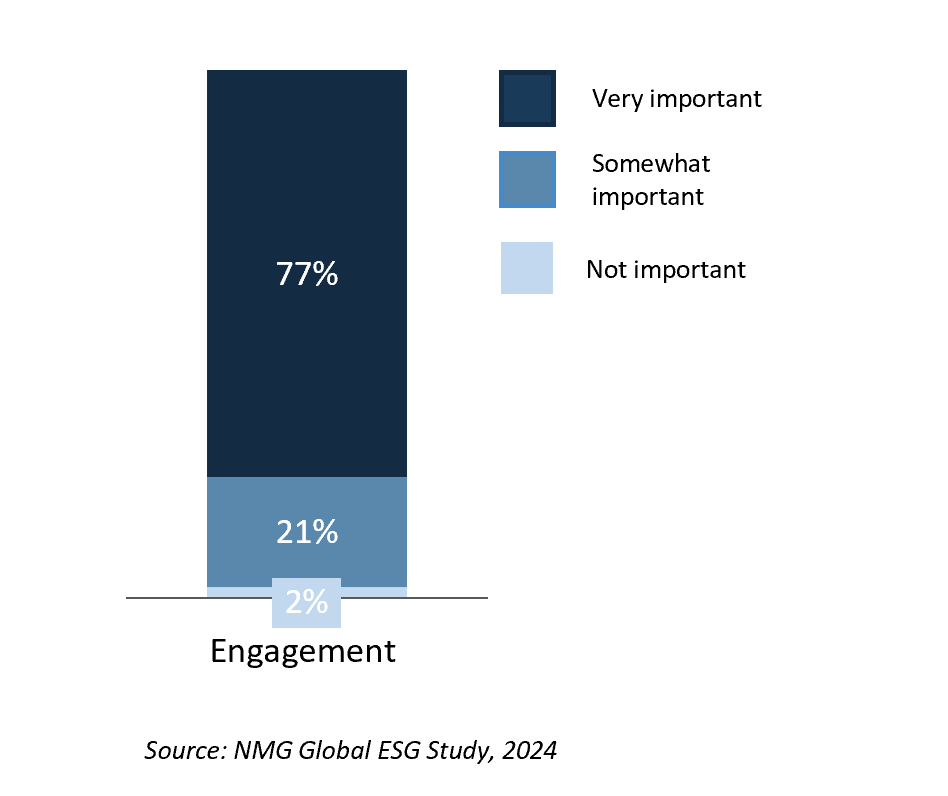

Exhibit 1: Importance in achieving climate change goals

Cited as “Very important” by 77% in 2024 — ranked #1, up from #3 in 2023

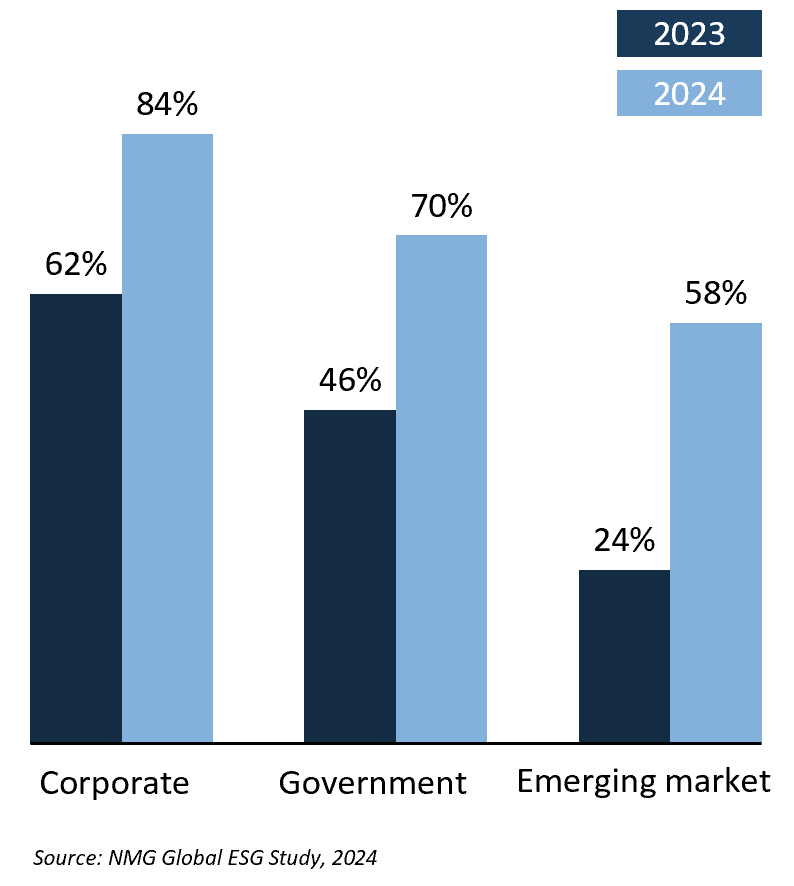

Incorporation of ESG in bonds is rising sharply — with +22% growth in corporate bonds, +24% in government, and +37% in emerging market debt. Asset owners tell us they lack product options; this is an opportunity for innovation.

Exhibit 2: Incorporation in fixed income

% selecting high or moderate incorporation

Interest has been building in areas like biodiversity, and early movers have gained reputational and commercial advantage – as earlier studies showed with the energy transition. Well-considered and investment grade innovations are welcome and can help bolster awareness and credibility.

These trends reflect a shift away from broad ESG labelling and toward targeted, solutions-driven approaches. Investors now set a higher bar — asking not who says the right things, but who is building the right frameworks, products, and partnerships.

This shift, from early promise through a necessary course correction into a more evidence-led phase of adoption, is a deliberate move toward sustainable practices that are measurable, material, and built to endure.

Now renamed the NMG Global Sustainable Investment Study, this year’s edition will again identify and track evolving market dynamics while continuing to measure asset manager leadership, assess manager capability perceptions across key selection factors and relative to peers, and capture in-depth feedback from asset owners.

The 2025 edition launches soon. If you are an asset manager looking to understand how you are perceived — and where the most credible opportunities now lie — reach out to us to learn more.