August 23, 2019

The Innovation Imperative

The level of collective investment focused on transforming the life insurance proposition exceeds anything seen in the…

M&A strategies in the primary P&C broking segment often have unintended ramifications upstream. And, on occasion, industry segments can become over-consolidated. In the case of reinsurance broking, two global giants would likely be too few, potentially pushing insurers to seek out new reinsurance broking partnerships in response. Maybe.

‘Aon Willis’ was a possibility for all of 24 hours only to be shelved for a minimum of twelve months. As it is common practice to do regular and comprehensive reviews of key competitors and was a forced disclosure, perhaps no further contemplation is merited. It did offer food for thought, however.

The recoil from the initial announcement indicated this was both unexpected and shock-inducing in terms of what it might have meant for the competitive landscape and jobs in broking generally.“The reinsurance broking industry is at the same time both consolidated and fragmented”

Such transactions are necessarily premised around primary (as opposed to reinsurance) broking businesses. Broking models are vertically-integrated, underpinned by significant operational synergies, meaning primary market motivations usually have significant knock-on effects in reinsurance broking.

A trawl through our global database reveals that there are well over 100 reinsurance broking firms globally, although just four have genuinely global franchises. The reinsurance broking industry is thus at the same time both consolidated and fragmented.

Post final approvals, Guy Carpenter’s absorption of JLT Re will serve to create two broadly equal-sized global giants in reinsurance broking, with the next competitor (Willis Re) being about half their size. Were Aon to acquire Willis Towers Watson the number of genuinely global reinsurance brokers would reduce to just two. What might be the ramifications for the reinsurance broking segment, and for the value chain in general?

While insurer consolidation and decision centralisation are key challenges for reinsurance brokers, there are also growing revenue pressures (rebates and/or fees). Reinsurance brokers also receive regular signals for investment in terms of new capabilities, particularly data modelling and keeping pace with new technologies, propositions and business models.These support the case for scale advantage and hold relevance for a consolidation thematic.“Under the Aon Willis scenario, the two largest brokers combined would likely account for up to two-thirds of the reinsurance broking industry”

On a ‘steady state’ basis: Aon Benfield + Willis Re could expect to be 50% larger than Guy Carpenter + JLT Re, a scale differential that would be unlikely in itself to cause concern at an industry level.

These two largest reinsurance brokers combined would then however likely account for up to two-thirds of the reinsurance broking industry (by revenue and by number of active brokers). In the absence of any meaningful shrinkage, ‘Aon Willis Re’ would potentially be 15 times the size of the third-ranked competitor.

How well would the resulting industry structure post Aon Willis fit with insurer requirements?

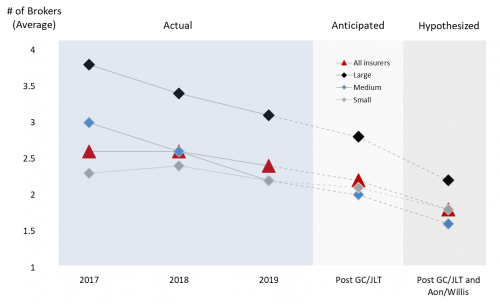

Source: NMG’s Global P&C (Re)insurance Programme (2017-19, Forecast)

On average, ‘Large’ insurers today make use of three reinsurance brokers (down from nearer four two years ago), in so doing benefiting from a diversity of expertise, analytical models, and a multitude of pathways to test market appetite and pricing via different networks. ‘Medium’ and ‘Small’ insurers currently make do with just over two.

Insurers seldom indicate plans to trim the number of brokers used, yet there is quantitative evidence for rationalisation of broker usage, driven by both demand and supply factors.The effects of Aon Willis would be most pronounced among large insurers: two-thirds use three or more brokers, of which nearly 90% use all of the big three.

At-scale brokers have broadened their offerings, narrowing the ‘slots’ available for the differentiated propositions of others to fill. So far, it would seem, insurers have found this sufficiently compelling. Consolidations – pending and hypothesized – would however have a considerably greater effect.

Guy Carpenter + JLT Re is unlikely to impinge significantly on insurer choice, reflective of the relatively smaller client footprint of JLT Re. Willis Re has twice the client footprint of JLT Re however, which would translate to a fall in average usage to just two brokers under Aon Willis. The effects would be most pronounced among large insurers: two-thirds use three or more brokers, of which nearly 90% use all of the big three. It would seem reasonable that Large insurers could most feasibly look to build new relationships, thereby capping the scale and efficiency benefits available (even assuming some of these efficiencies would be shared with clients).

Many of the leading value drivers for broker selection, including personal relationships, domain expertise, and service quality can be achieved in the absence of scale. ‘Boutique’ brokers may well be successful operating on a business-as-usual basis despite large-scale consolidations taking place, possibly even experiencing favourable tailwinds by way of increased vibrancy in their segment. This could be particularly relevant for larger boutiques, where an aggregation play might now hold more appeal (ie to become the distinct third-ranked reinsurance broker).

The bear scenario for boutiques lies in the idea that consolidation activity will move broker engagement models from a setting of preference to one of need, with buyer behaviours shifting permanently towards few reinsurance broker partners as a result.

Mostly likely, contemplating the full range of scenarios, reinsurance broking will remain a highly dynamic segment.