January 4, 2022

Will insurers continue to dominate the Canadian Group Retirement market?

Many pension systems globally started with insurers dominating the competitive landscape, though insurers often struggled to retain...

Big Canadian insurers’ dominant position due to their recognized brands can be challenged by smaller providers, according to NMG’s 2022 Group Retirement Study. The study highlights concerns over relationship management, pricing discrepancies, and differing member experiences for clients and intermediaries.

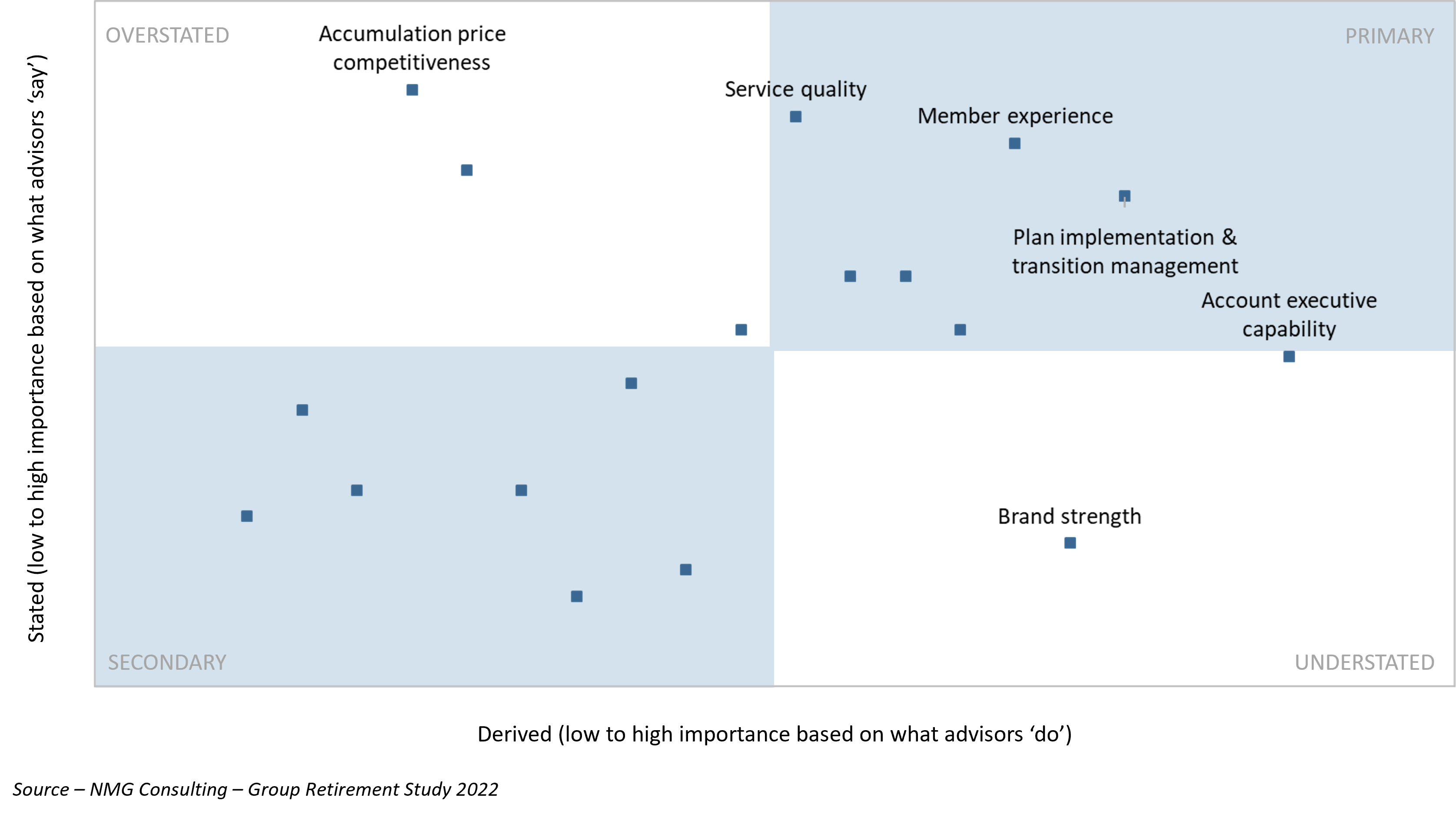

NMG’s 2022 Canadian Group Retirement Study collected feedback on the service factor group retirement consultants and brokers state is most important when selecting a provider. Price competitiveness, service quality and member experience round out the three most important drivers for selection as stated by intermediaries. The data also unlocked the behavioral factors that drive selection of a group retirement provider. Despite what intermediaries say is important, our analysis shows that brand strength is overly rewarded, as illustrated by Exhibit 1.

Exhibit 1: Key provider selection drivers

Relationship management rating is an average composed of 11 distinct service factors, scored out of 100

Price competitiveness is also in focus in the Canadian group retirement market as fee compression persists across the industry. Although the big three providers lead on market share, this position is not unshakeable based on evidence from international markets. Look no further than the US, where fee compression was a core contributor in the erosion of dominant insurers’ market positioning.

In Canada, the providers outside the big three have increased their price emphasis, offering flexible and transparent pricing that has been well received in the market. Although price alone may be insufficient to disturb the big three from their lead market positions, momentum may shift when integrated with high quality service, member experience and investment offering.

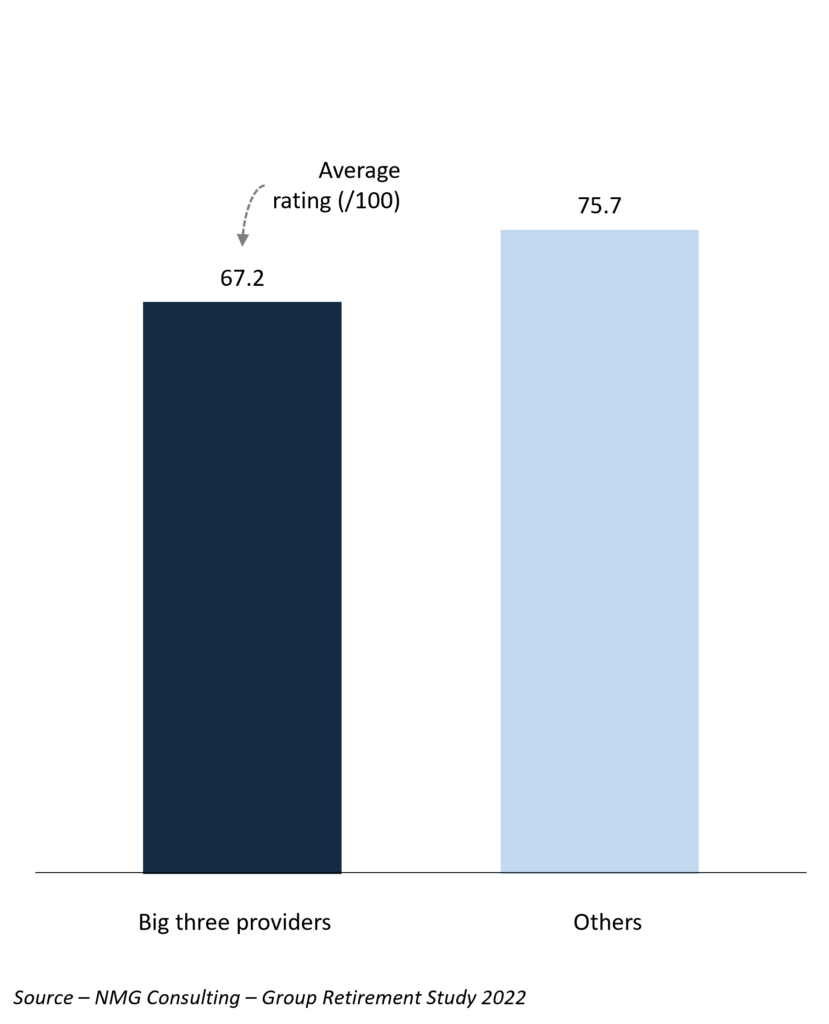

The impact of the pandemic continues to affect Canadian group retirement providers as talent retention and the associated loss of knowledge create challenges for providers. Staff turnover across the industry has led to a decrease in the quality of touchpoints and a loss of experienced staff necessary to answer nuanced retirement questions from sponsors and retirees. This has challenged the big three insurers more significantly as their turnover has been twice as disruptive compared to that of other providers. This disruption has contributed to perceptions that challengers have delivered higher service quality than the big three providers, as illustrated by Exhibit 2. These factors include faster response times, better accessibility, and more consistency.

Exhibit 2: Average relationship management score

Rating is composed of 11 relationship management factors, rated out of 100

Despite being smaller in stature, providers outside the big three have led the industry when it comes to investment in member experience. Insights from our study revealed that the big three providers average score was nearly 10% lower than smaller providers regarding member experience. Retirees value easy to use online portals that deliver access to customized information and tools that meet their needs. The smaller providers in the Canadian group retirement market have been exceptional in delivering on this while also continuing to innovate their online tools that further amplify the overall experience. Although the big three are not far behind, they are top heavy, as ratings are skewed by one provider’s strong website, infrastructure, and digital insight capabilities. Should the other two providers from the big three neglect this area, they risk falling further behind and cementing themselves as outdated.

The Canadian group retirement industry is at a pivotal moment where the dominance of the big three insurance providers is being challenged. As the smaller providers dedicate more resources to relationship management and talent retention, they have further reinforced their position in the market as service leaders. Their commitment to win on price factors coupled with their best-in-class member experience has created notable differentiation for these smaller providers. Furthermore, as the challengers develop their brands, the big three are at risk of losing out with clients and intermediaries who adopt brand strength as a leading placement factor. In our opinion, the industry is primed for providers that can deliver more competitive member pricing, service, and digital experience.