October 29, 2020

Low cost OR high performance: super funds to decide

There is enormous disparity in fees and performance of MySuper funds (and there isn’t necessarily a positive…

It has been difficult to miss APRA’s frustration at the lack of consolidation amongst super funds. The proposed annual performance testing (along with penalties for underperformance) in Budget 2020 may finally provide APRA with the tool to force the Trustee boards of underperforming funds to make the inevitable choice.

The test

Regulators are ostensibly concerned that members can fall victim to the ‘unlucky lottery’ and be ‘stuck’ in underperforming funds. The annual performance test reform is designed to remedy this situation by subjecting MySuper funds to a regular test of long-term performance (net of fees) against an APRA-constructed benchmark tailored to each fund’s asset allocation. Funds that exhibit long-term underperformance of >50bps pa will fail the test.

The reform requires funds that fail for the first time to notify members of their underperformance, and refer them to a new YourSuper comparison tool where they’ll be provided with fee and performance information on alternative MySuper funds. Failing two consecutive tests will prevent the MySuper fund from taking in new members (until performance improves).

Immediate implications

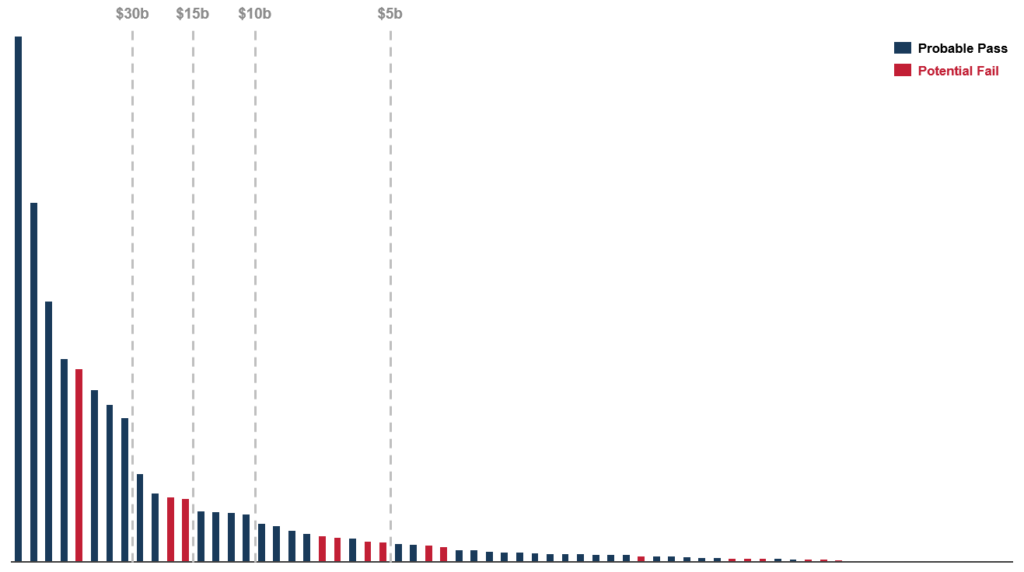

The reality that will be dawning on many Trustees is that there may be no realistic way for them to bring their long-term underperformance up to scratch. The hole for many is just too deep. And if the reforms pass as drafted, those funds will be unable to take on new members for at least a year (and we suspect in some cases, for several years) from July 2022. Looking at current performance data from APRA’s heatmap, over a third of MySuper funds (representing 16% of total assets) are vulnerable to this exact fate.

MySuper FUM (including proposed mergers, excluding tailored MySuper) – June 2020, $b

Failing two successive tests will prove terminal for many funds. Even after the ban on new members is lifted, access to employer arrangements and awards will have been irreparably revoked. The situation for these funds will be further exacerbated by the outflows from members prompted by the notifications of underperformance and a blacklisting in the league tables. These consequences, compounded over several years, will result in a significant loss in market share, brand strength, and revenues, while costs remain fixed.

Action required now to avoid slow, inevitable failure

This leaves underperforming funds with two options; commence the search for an appropriate suitor (no simple task for many funds given acquirer-funds’ limited appetite to incur the transaction costs for small funds); or accept their fate and hope they’re able to weather the storm (many won’t).

This reform also presents a set of unique opportunities for the outperformers:

This initiative is squarely focused on punishing underperforming funds and there is no doubt a lot of lobbying to be done before it is legislated. In its current form, it’s terminal for many funds, and a clear opportunity for those in a strong position and on the front foot.