June 23, 2020

When it comes to advisor support during COVID-19, a few asset managers and recordkeepers are pulling ahead

Still an opportunity to stand out Asset managers and recordkeepers have done a good job of helping…

COVID is clearly more than a ‘phase’. Whilst the spate of super proactive communications has died down it is clear asset managers need to identify a sustainable model for sales and servicing that isn’t overly reliant on face-to-face interactions yet delivers clients and asset managers what they need.

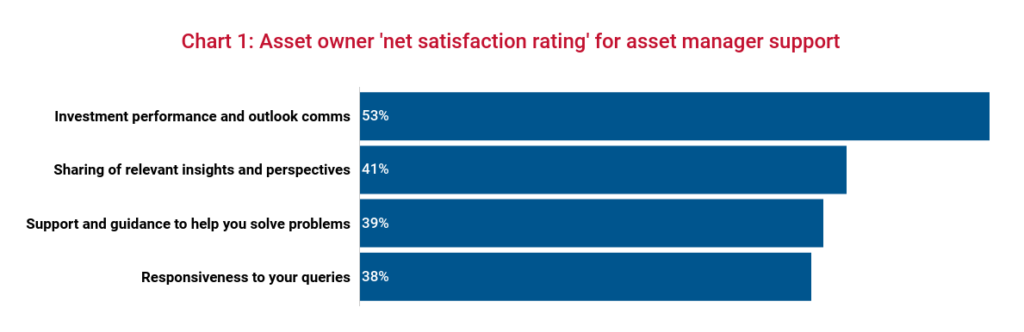

First, the good news. Our recent COVID-19 Volatility Study found that institutional asset management clients are mostly happy with the service managers have provided. Particular highlights are the way that investment performance and market insights have been communicated.

Source: NMG COVID-19 Volatility Study

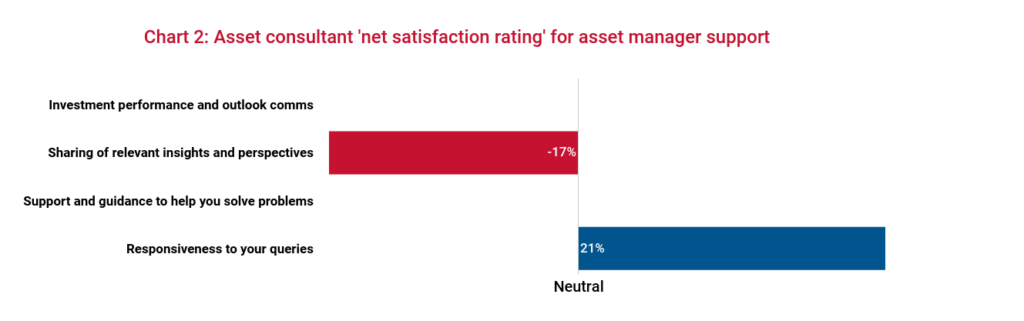

However, asset consultants have proven much harder to please, which is concerning given the highly concentrated market and strong position of investment consultants in Australia. Relationships can be strengthened during crises, and it’s clear from the chart below that a focus on communicating with asset consultants – particularly on market insights and perspectives – presents an opportunity to stand out. It seems a targeted and proactive approach to engaging with consultants (rather than just being responsive) is what’s required here.

Source: NMG COVID-19 Volatility Study

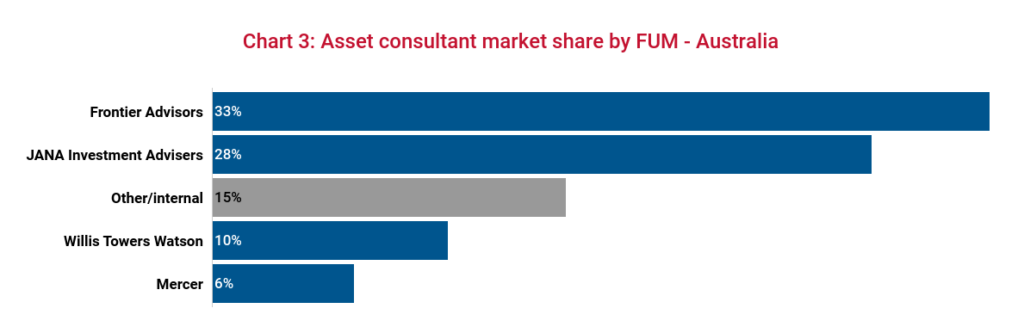

And it’s not as though this requires a great deal of resource allocation. There are only four primary asset consultants that matter in the Australian market, together holding 77% market share of Australian not for profit super funds.

Source: NMG Super Funds Review 2019

So, what specifically can asset managers do?

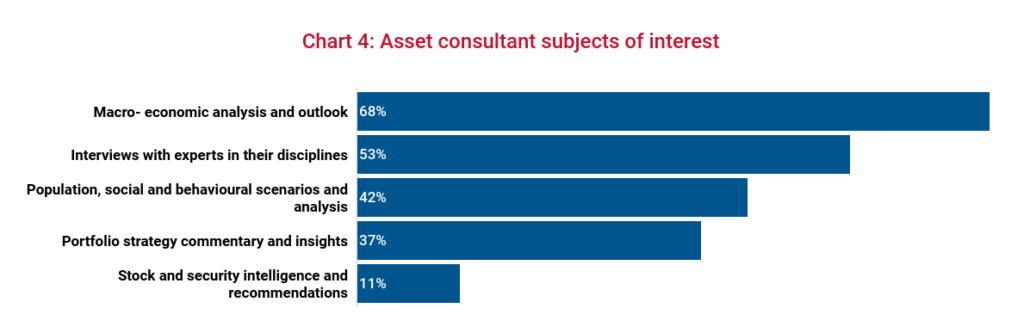

When it comes to asset consultants, not all types of engagement are equal. There is a high demand for expert interviews and macro-economic analysis and outlook, whereas generic portfolio strategy and stock commentary generate little interest.

Source: NMG COVID-19 Volatility Study

While institutional asset managers may have missed asset consultant expectations so far, the reality is there remains an opportunity to stand apart from peers in delivering more access to the experts within your firm.