September 13, 2022

A future industry structure

Advice propositions today are largely based on providing consumers with comprehensive advice (considering a wide range of...

There has been a lot said over the past few years about “rise of the (superannuation) titans”. ‘The Titans’1, having now well and truly risen, and with the contributing industry and regulatory conditions generally well understood, we thought it worth a discussion on what comes next.

In the simplest sense, the superannuation industry (like most others) competes on two factors: price and proposition. The fact that price is the only lever with which to fund increased proposition (ex-performance, which is not our focus here) for most market participants clearly favours an ability to generate large amounts of investable capital with small price movements, ie superannuation is primarily a scale game.

The question that we are concerned with today is: what happens to the competitive dynamics of a market that favours scale in the age of the Titans?

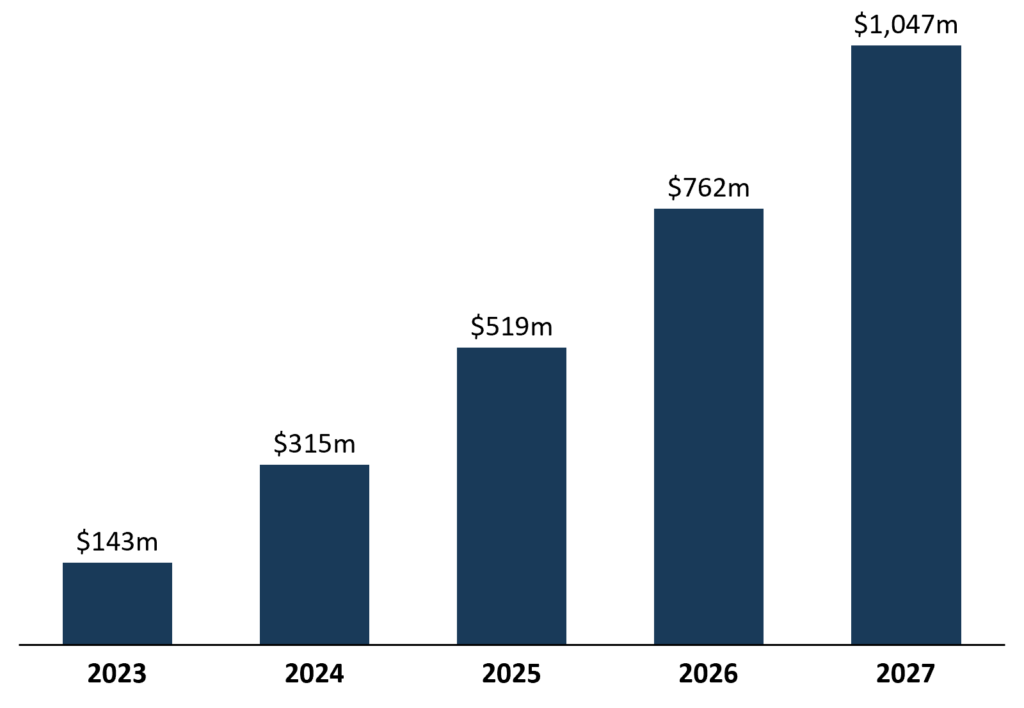

Exhibit 1: The Titans’ war chest (annual value of scale economies for Titan funds) 2023F – 2027F, $m

The impact of ongoing scale economies on the surplus cash generating capacity of our Titans over the next five years

There are layers of assumptions behind this sort of modelling that make it possible to produce a wide range of notionally sensible outcomes. Whilst we are confident in our forecasts, the scale economies in this sector, and the seemingly inexorable ability of our Titans to capture market share, mean that whichever way you cut it, our Titans have the capacity to passively generate huge amounts of investible capital over a short period.

The deployment of these war chests comes in two forms: reduced price and (or) enhanced proposition.

The degree to which our Titans will be able to deploy these war chests towards proposition comes down to a view of price elasticity in the market, ie where they think they need to be on price, now, and in the future.

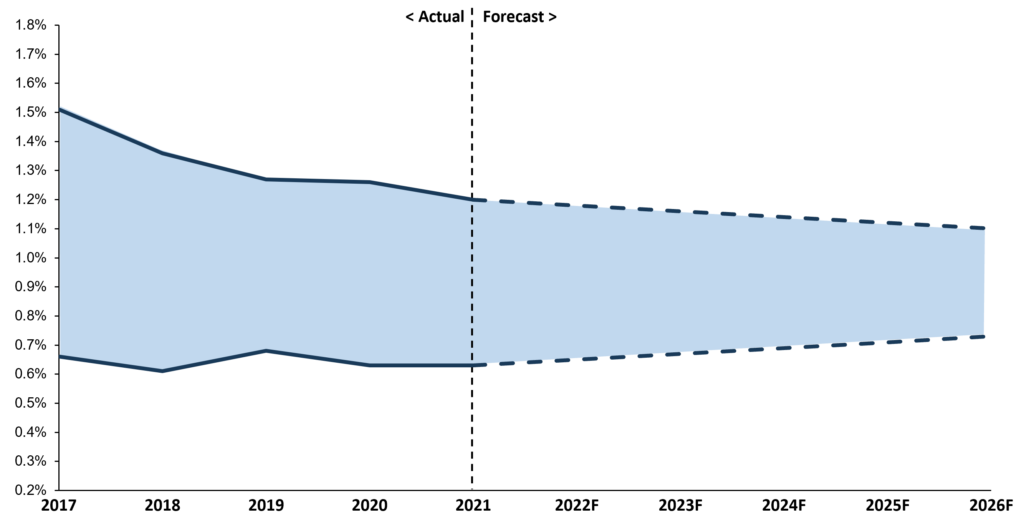

Exhibit 2: MySuper ($50k, balanced) price range for top 5 funds by inflow in each year 2017 – 2026F, %

The spread of the headline price for the top 5 funds by member directed inflows2

It is clear from the above that there is a pricing range that funds must be within, and whilst this range has (and will continue) to tighten, there is plenty of room to play here. What also became clear through this analysis is that there is no apparent benefit to undercutting this range, ie the cheapest funds are not winning the contestable flow game.

This suggests that we are in a market which is not as fixated on headline rates as some may believe3. It also suggests that – within certain bounds – members may not penalise their fund for generating investable capital through price increases.

The impact of Vanguard’s entry into the superannuation market on these dynamics is yet to be seen, however, the idea of many funds aiming to be differentiably cheap in a market where Vanguard is a competitor is doubtful.

Given the apparent inelasticity of demand, ’proposition’ must be the key competitive battle ground for most funds. Investment in proposition will broadly take two forms:

Investment performance will of course continue to be critical, however given it is not usually possible to “buy” better long term (gross) performance, it is not our focus here.

The implication of the recent Quality of Advice consultation paper is also sure to be top of mind here for our Titans. In coming articles we will discuss our views on how this investment in proposition is likely to play out.

The good news for most funds is that the prospect of having to compete on price against opponents with multiples greater scale economics should now seem less daunting – whilst it is critical to be price competitive, you don’t have to lead on price.

The other good news is that many funds will have more optionality in their pricing strategies than they may have thought. This provides opportunity to generate investable capital through price increases – noting that a fund’s licence to do so will be heavily dependent on their customer base and performance track record.

The key for small and mid-tier funds will be choosing how and where to invest in their member proposition. This will of course be different from fund to fund and will require a deep understanding of member value proposition as well as internal capabilities.

[1]Note here that “Titan” refers to the 4 largest funds: AustralianSuper, ART, Aware and UniSuper.

[2]Which excludes the impacts of SFTs from M&A / fund consolidation.

[3]The obvious challenge here is the success that HOSTPlus had with The Barefoot Investor, worth noting though that despite the book touting HOST’s index option, most of the flow appears to have landed in their not-at-all-cheap, but strong performing, MySuper product.