February 17, 2021

ETF growth up, but new entrants fight over 4% of FUM

The ETF market recently passed a significant milestone, reaching $100b of assets in January, and we thought...

We have previously cautioned managers on sprinting headfirst into the active ETF market, which is much more complex than it appears. Those complexities notwithstanding, we remain (sensibly) bullish on the future of the Australian active ETF market.

It has been a tough start to the year for ETFs (and for asset management in general), headline flows into ETFs to H1 CY22 were down ~23% period-on-period, with market volatility testing the nerves of many investors. However, looking beyond the headline numbers, there’s still a lot to play for.

As we discussed in our previous article, the passive and smart beta markets in Australia are only contestable for a small few, and margin pressures make the proposition attractive for fewer still. Whilst this market still dominates in terms of flow and FUA, most of the competitive activity occurs in the active segment, which, save for one notable exception, has held up relatively well this year.

Active ETFs have a long way left to run

The active ETF market remains, and will remain, an (almost) entirely adviser led proposition. The flood of new entrants to this market and the advent of the dual listed/unlisted structure means that the decision on listed vs unlisted is increasingly driven by advisers’ implementation preferences rather than any philosophical views on product structuring.

This loss of distinction between listed and unlisted in the advised market is going to see strong flows into active ETFs for the foreseeable future.

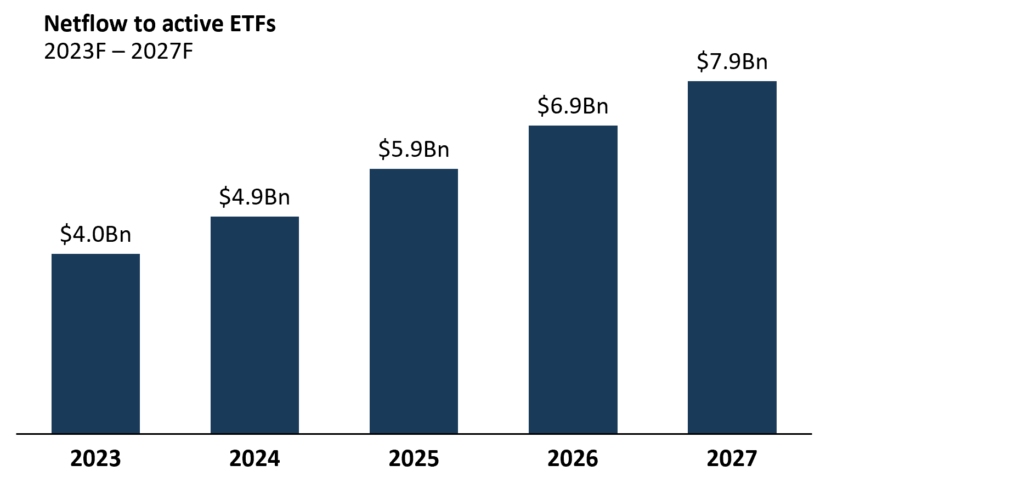

Exhibit:1 Forecast netflows into Australian active ETFs

Source: NMG Asset Management Stock and Flow model

The key question for managers, as always, is “How do I best position myself for success”.

Firstly, where is the money going?

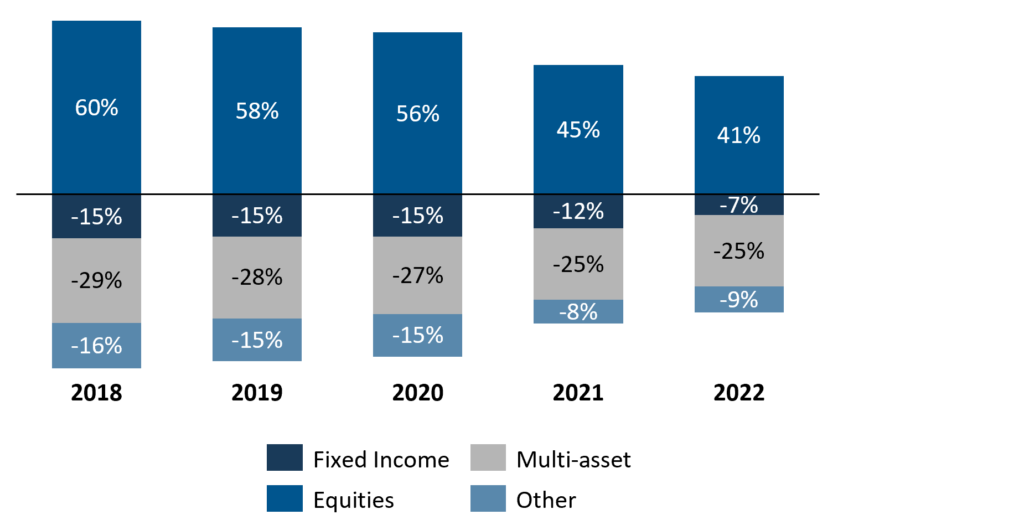

The loss of distinction between listed and unlisted offers some insights here. Over time, we’ve seen, and we will continue to see, the asset allocations of these markets converge.

Exhibit 2: Active EFT asset allocation relative to active managed funds, 2023F – 2027F

Source: NMG Managed Funds Review, MorningStar, ASX

There are a few takeaways here:

So what can managers do to best position themselves?

This is an immature market with enormous growth potential and plenty of contestable flow to go around. That being said, this is a complex market with no guarantees of success, so here are a few key points which must be understood prior to diving into it: