April 24, 2023

Active’s silver lining

On an outlook of healthy contestable flows, plenty of opportunity exists for well-positioned retail equity managers in...

In a retail market starved of growth opportunities, the prospect of new capital pools offered by active ETFs continues to entice asset managers in Australia. To date, despite a flurry of new entrants, few active managers have achieved genuine traction however.

The ETF market showed marked resilience over 2023, a year that will go down as the worst on record for retail managed fund flows, posting 12.6% growth for the year. And while passive ETFs continue to dominate the flow, active ETFs had a commendable year.

2023 saw 31 new active ETFs brought to market, and 8 new issuers. 75% of active ETFs saw net inflows, and, with the exclusion of Magellan, the active ETF market notched up $1bn in net inflows for the year.

And yet, despite this surge in new entrants as well as plenty of interest in active ETFs, success in this market has proven out of reach for most participants.

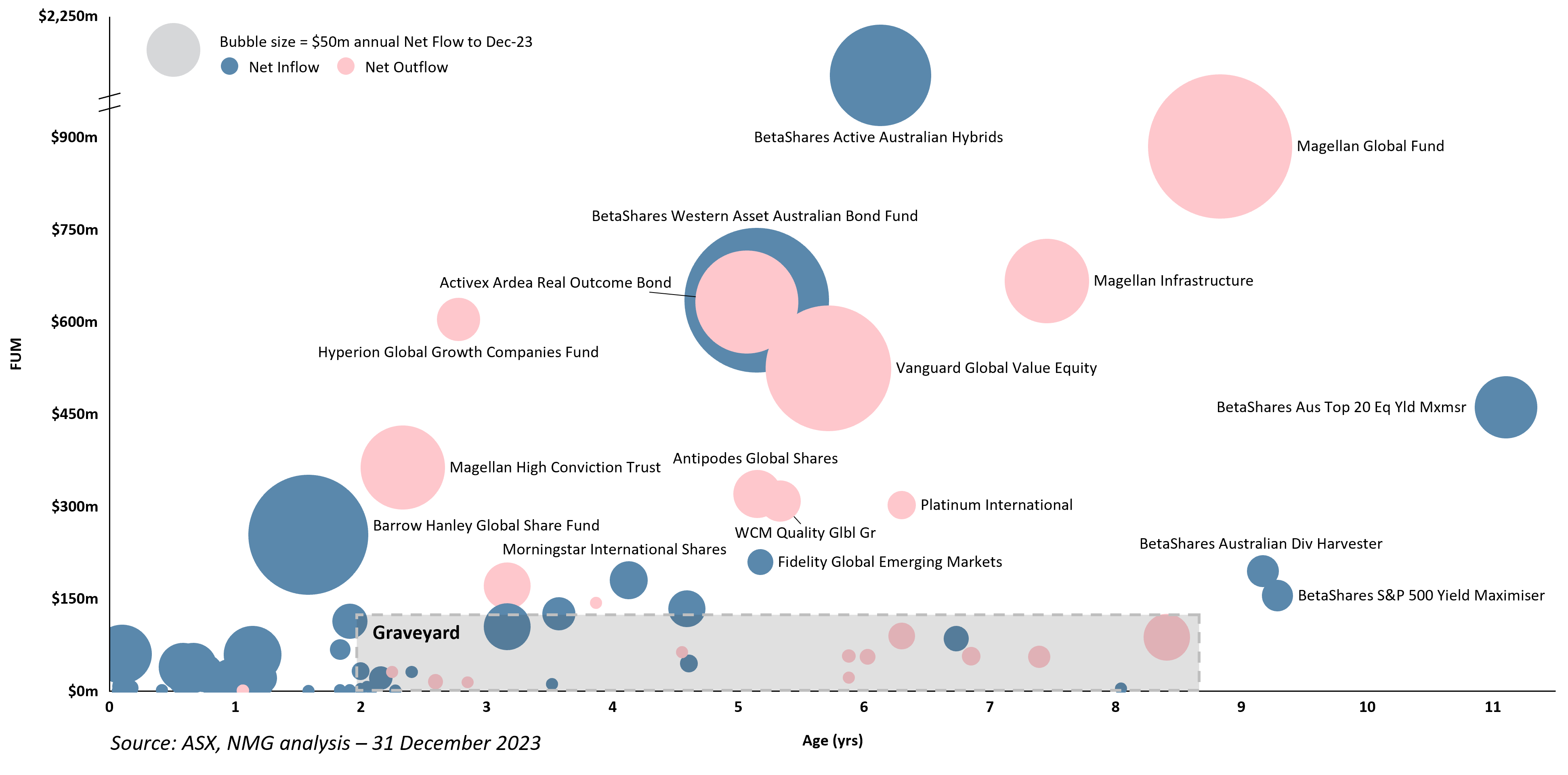

Over half of the active ETFs currently on exchange remain sub-scale two years after listing, and that proportion is expected to grow considerably.

Exhibit 1: Active ETF Landscape, Australia

This growing ‘graveyard’ of established sub-scale funds should serve as a warning to managers that entry into the ETF market is not for the faint of heart. It should also serve as a reminder for some to stop throwing good money after bad – the discipline of closing unsuccessful funds is often underappreciated.

For managers whose business case for entering the active-ETF segment relied on accessing direct and broker channels, reality may have come as a shock.

NMG’s analysis of the flows into dual-access funds (those with both listed and traditional non-listed entry points) shows no evidence of exchange listings generating significant incremental flows to strategies post listing. This suggests that managers have so far been unable to access genuinely new capital pools via listed offerings.

This outcome is not particularly surprising. The fact is, most active managers in Australia do not have the retail brand presence to generate meaningful flow from the direct channel, and most distribution teams are not yet set up to serve the broker channel well.

The result is that active ETFs are, and likely will remain, an almost entirely retail advised proposition, where most strategies are already accessible via platforms.

Whilst active ETFs are unlikely to be a growth engine for many managers, they should not be written off entirely.

Listed strategies are important as part of an omni-channel offering, particularly as advisers’ implementation preferences are shifting. To be successful here managers need to understand how advisers’ buying behaviour and implementation preferences are evolving, set their product and distribution strategies accordingly and be realistic about the size of the opportunity that ETFs offer.

The broker channel is also a genuine option for a select subset of managers. Given the level of market and client sophistication, success in this channel requires top-tier product (first quartile returns and a novel / hard to replicate offering) and a dedicated distribution capability. Pointing an existing retail wealth distribution team at this channel will not yield results.

And finally, acquisition costs and retail brand awareness mean that material direct channel growth is a fairytale for all but a very select few – managers should invest their time and resources accordingly.