February 23, 2022

Canada Group Retirement

Below is the Insights Partner Report from the 2021 Canada Group Retirement study. Please scroll down to...

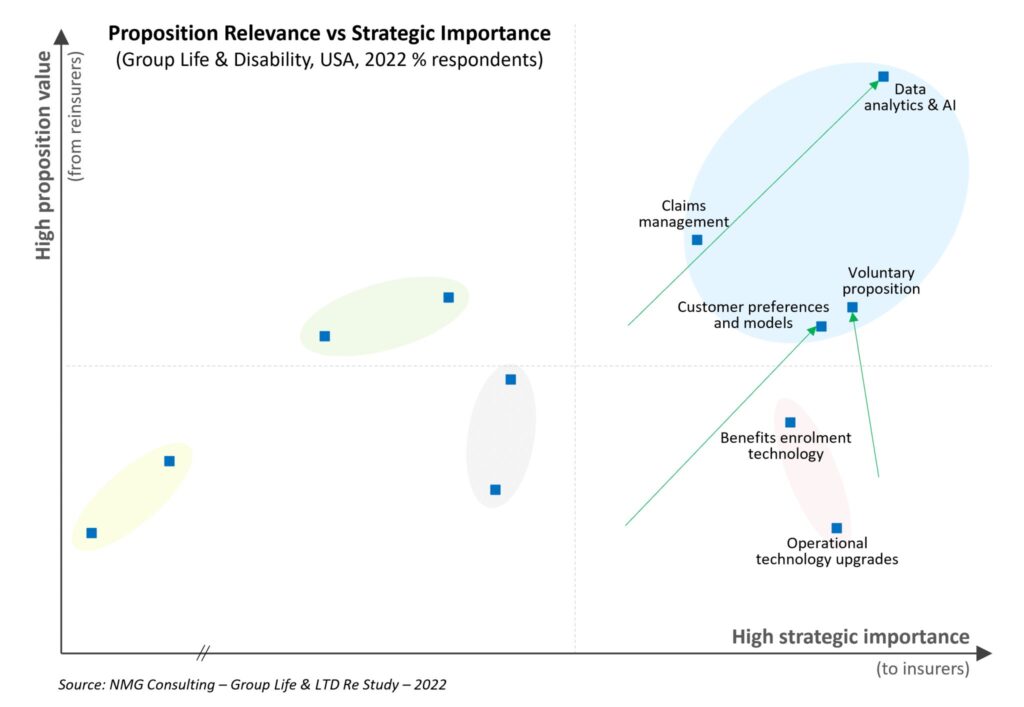

In the dynamic realm of US Group Life & Disability insurance, insurers continuously adapt to challenges. Key priorities include modernising technology, embracing data analytics, and understanding customers.

Insurers’ strategic priorities often speak to the challenges and opportunities in any given segment. In the case of the US Group Life & Disability:

Reinsurers seemingly have more ways to support group insurers than just a few years ago, with the value of reinsurance propositions lifting sharply across many key areas.

Exhibit 1: Strategic landscape at a glance

High proposition value vs strategic significance

How will the priorities of group insurance executives have shifted since, during which there have been significant advances in APIs, AI, and of course most recently Generative AI?

Our 2024 Study of the Group Life & Disability segments appears well-timed to explore competitor readiness for – and the level of adoption of – these rapidly emerging technologies.