March 18, 2021

Increased opportunity meets rising opportunity cost

It has been a long time since prospective margins in US Commercial Lines look as attractive as...

High Net Worth-focused insurers in Asia are increasingly optimistic after weathering a challenging 2020; NMG’s research suggests that a few leading players will dominate growth and economics over the next 3 – 5 years.

The past twelve months were challenging for the Asian High Net Worth (HNW) life insurance market: sales declined materially in Q2 as global COVID restrictions ended cross-border travel. However, sentiment rebounded throughout the second half of the year with a particularly strong finish in Q4. NMG expects positive momentum to continue into 2021, though with significant variation in outcomes for providers based on their franchise, product orientation and business capability.

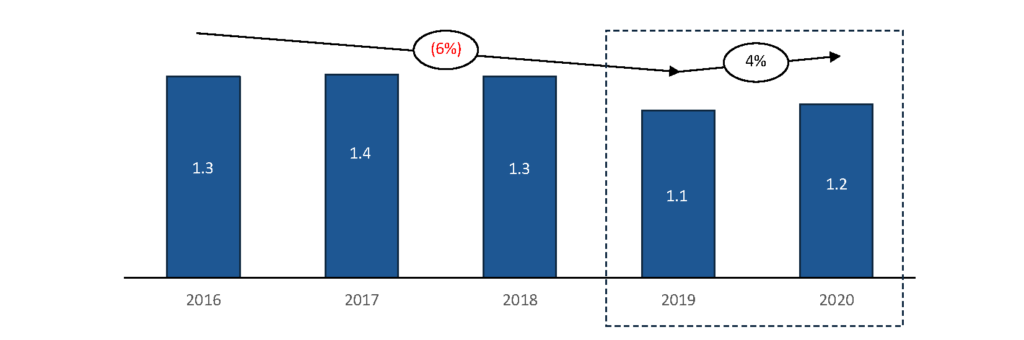

On NMG’s numbers, Asia HNW1 life insurance volumes were USD1.2bn in 2020, up 4% on 2019, though still materially down on ‘high watermark’ levels before heightened restrictions on the capital outflow from China and the Hong Kong protest movement. We estimate that Asia accounts for approximately ~15% of total HNW life insurance sales globally.

Figure 1: Asia HNW Life Insurance New Business (APE, USD bn, 2016 – 20)

Source: NMG Asia HNW Market Sizing

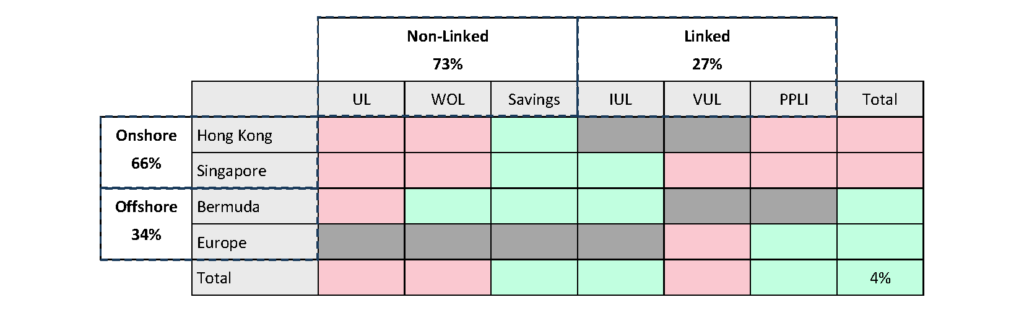

It is important to note, however that volume dynamics differed materially by product, domicile and channel:

Figure 2: Asia HNW Life Insurance NB Growth Rates by Product/Domicile (%, 2020 v 19)

Note: red cells represent negative APE growth, grey cells represent nil participation of the domiciles in certain products, and green cells represent positive APE growth

Source: NMG Asia HNW Market Sizing

Asia remains differentiated from the global HNW (wealth planning) market, where private placement unit-linked solutions (PPLI) dominate. While PPLI allocations increased materially from a low base, this represents ~15% of the Asia HNW market (though we estimate >25% of UHNW).

We expect a continuing rebound in 2021 and growth over the mid-term, again with significant variability in outcomes based on franchise quality, breadth of proposition and capability depth.

We observed a sharp recovery in new business volumes in Q4 2020 (though this was partially due to a ‘fire-sale’ of keenly priced products flagged for closure in early 2021). However, underlying demand remains high so that continued strong momentum into 2021 is expected due to the:

We believe the build-up of technical depth and placement capability will support placement activity across a broader range of customer segments and needs. We also see robust provider appetite underpinning supply across segments and product categories (including new ‘start-up’ insurers, global specialists building up their regional presence, and established regional insurers looking for growth outside traditional segments and channels). Our central forecast scenario is for aggregate new business growth of between 10 – 15% over the next three years.

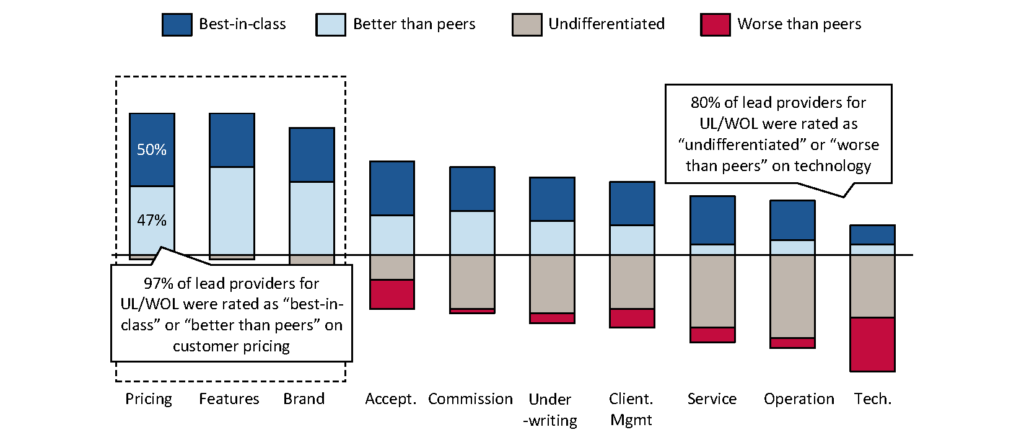

Price, product features and brand are considered hygiene factors required to win HNW business: the ‘lead insurers’ (those insurers capturing the highest share-of-wallet) are consistently cited as above-market on these factors. Note that brand quality here (when cited by specialist distributors) indicates the broader perceptions of insurer specialisation, commitment to market and ‘true to label’ rather than consumer brand awareness.

Insurers considered non-competitive across these key factors will struggle to capture and defend material share-of-wallet. However, for insurers considered competitive on these factors, there is then the scope for differentiation in terms of factors such as business acceptance (including the capacity to write jumbo cases or accept from niche geographies), underwriting and client management.

Figure 3: Key Characteristics of Lead Insurers (2020)

Source: NMG interviews with HNW brokers

Organisational factors are important, too. In 2020, the leading insurers in terms of share were pro-active and flexible in responding to the placement and acceptance challenges attributable to COVID, were diversified across product and/or channel (or else able to quickly develop new products to meet the market) and were effective in managing internal and external stakeholders.

Looking forward, we expect a continuing focus on price and product features, though with additional areas of differentiation emerging. For example, we expect domicile to become an increasingly material factor underpinning competitiveness, based on both customer attitudes and acceptance factors. We have over the past 18-months seen marked changes in appetite for UHNW cases from some European centres, as well as movement in volumes booked into Hong Kong, Singapore and Bermuda (reflecting product speed-to-market and attitude to use of trusts).

Ultimately, insurers wanting to grow their proposition in the HNW segment must offer solutions covering products and services to meet the evolving needs of customers. NMG regularly conducts interviews with HNW brokers to benchmark their satisfaction with these carrier propositions.

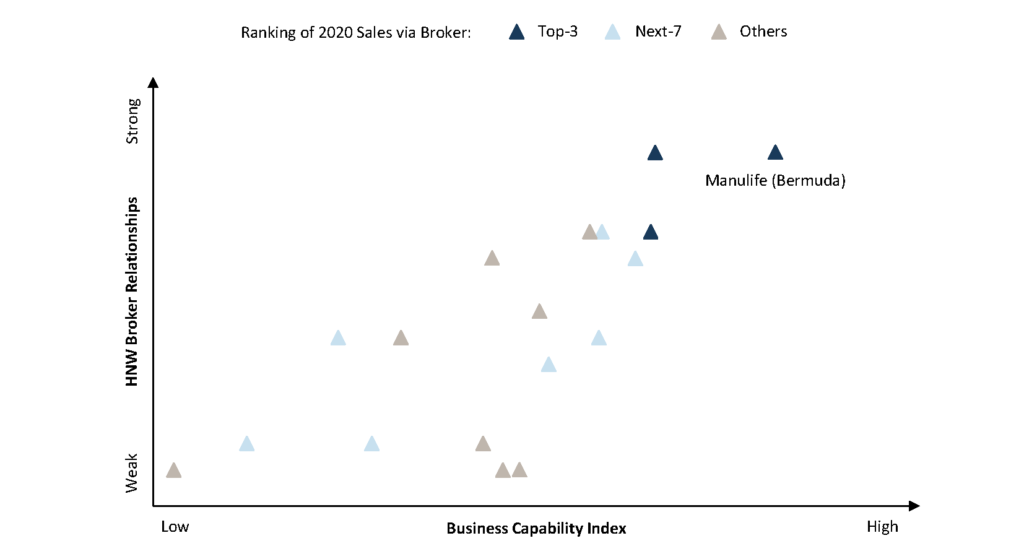

Our 2020 analysis demonstrates a handful of ‘stand-out’ insurers on capability metrics (Manulife Bermuda was top-rated by brokers), ahead of a crowded mid-market and long tail of ‘side-line’ competitors. We note that business-placement is generally skewed towards high-capability carriers, though with significant allocation into the mid-market.

Figure 4: HNW Life Insurer Business Capability Index (2020)

Source: NMG Asia HNW Broker Study 2020

Over the next 3-years, we expect a fragmentation and thinning out of the mid-market with a small number of committed participants bridging the gap to the leaders. The remainder (those with a narrow franchise or product range, or non-committed parents, or else poor service citations in the broker channel) will see their positioning and share decline.

We do in this transition expect to see an uptick in consolidation and exit activity. We do not anticipate the level of rotation from multinational insurers to specialists that we have seen in other cross-border segments (we expect insurers with a significant brand and distribution franchise in Asia to be strongly positioned so long as parent appetite for acceptance risk remains robust). Rather we anticipate consolidation to play out between the major Asian brands on the one hand, and the most capable and well-resourced global HNW specialists on the other.