April 23, 2020

COVID-19 spurs a shift back to active management

It’s no secret that passive investments have been on the rise – a global phenomenon that in…

With the unprecedented number of layoffs across Canada due to COVID-19, many within the group benefits industry are concerned. Our recent feedback from group insurance advisors suggests that this concern is widespread, particularly in regard to client related staff layoff and affordability challenges. The consequential result will be a fall in group benefits revenues and growth prospects.

Exhibit 1: Reported repercussions from COVID-19 (group benefits advisors)

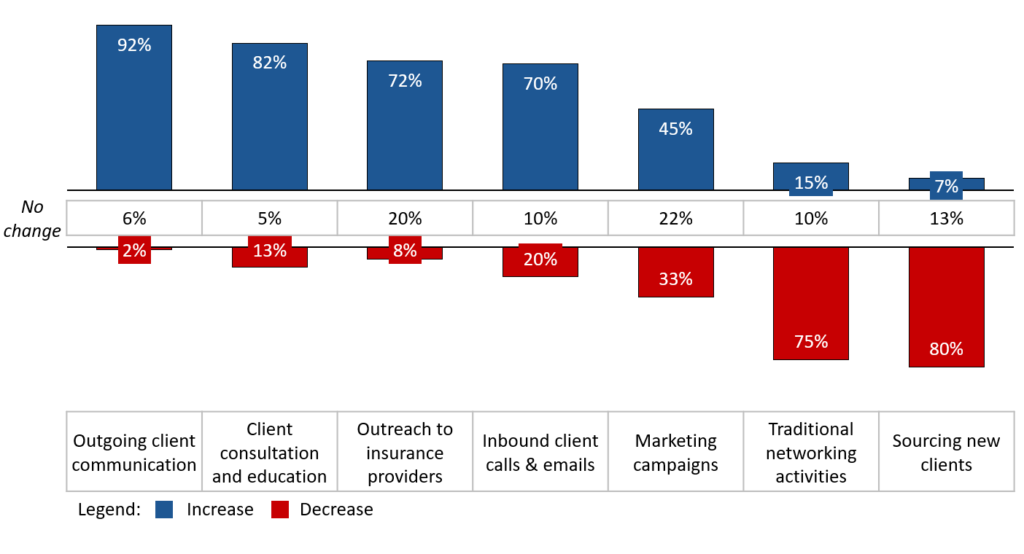

How are advisors tackling these challenges? They have dialled down business development and channelled energy towards client communication and education. The current environment has provided advisors with a unique opportunity to strengthen relationships with clients, possibly benefitting them in the longer term.

Exhibit 2: COVID-19 impact on advisor business practices

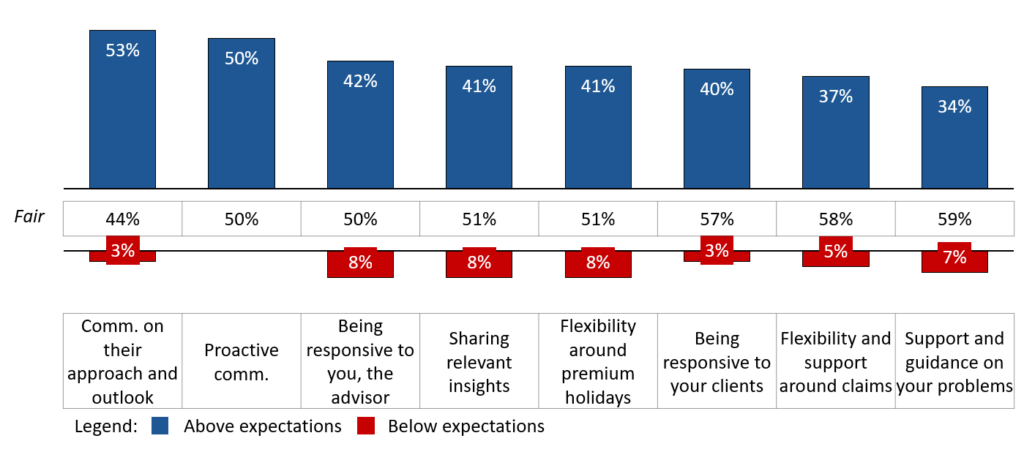

How have insurers responded during these uncertain times? Advisor feedback suggests that insurers have responded well with proactive and open lines of communication along with flexibility around premium holidays. Insurers have mostly outperformed expectations when supporting intermediaries through this crisis. Insurers that have exceeded expectations focused on proactive and transparent communication, responsiveness, flexibility in approach and premium relief. Insurers who have struggled to impress have been very reactive in regard to communication while being slow to respond to client needs.

Exhibit 3: How have insurers worked with you across these support areas

Advisors are seeking continued support from insurers through this period. The crisis will impact insurer brand perceptions and their partnership with advisors. As the industry develops their new normal, we expect those insurers that have proactively focussed on supporting their current clients and advisors to benefit, while those that have been more reactive will be viewed as transactional, pushed to compete primarily on ‘price’.