May 10, 2021

High Net Worth Life Insurance in Asia: Outlook and Opportunities

High Net Worth-focused insurers in Asia are increasingly optimistic after weathering a challenging 2020; NMG's research suggests...

Positive sales momentum and faster-than-expected rotation to digital and remote models in 2021 underpins the international sector’s resilience in the face of macro challenges.

NMG has conducted a proprietary key account study in the international adviser market since 2011, covering advisers based in international financial centres and in local catchment markets across Asia, the Middle East, Europe, the UK and Latin America. In 2021, our consultants interviewed 75 advisory firms, including global IFAs, specialist regional and national advisers and HNW brokers working with private banks and family offices, and identified the following key themes.

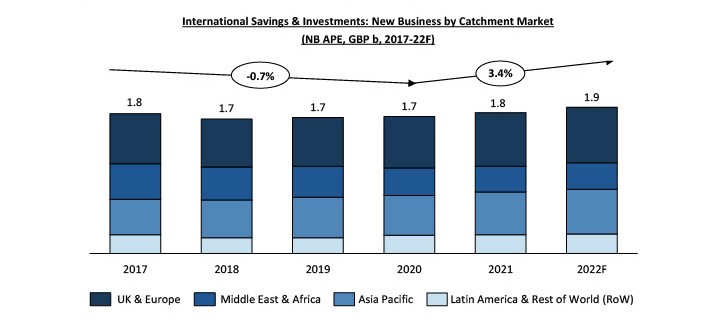

In our interviews, respondents pointed to an increase in 2021 new business volumes from the international savings and investments market, after a period of declining sales from 2017-2020 (Exhibit 1). The timing and quantum came as a surprise, as NMG’s past forecasts (up to 2020) had predicted flat volumes through 2021 and a modest turnaround beginning end-2022.

Exhibit 1: New Business by Catchment Market (2017-22F)

Source: Regulator data, Provider data, NMG Cross-Border Market Model 2021

This growth in sales in 2021 arose despite significant regulatory headwinds in the Middle East and the continuing impacts of COVID-19, highlighting a long-observed phenomenon: the resilience of the international savings and investment market in the face of macro challenges such as market or commodity shocks (and evidently, pandemics).

We have previously observed that international advisers and providers tend to benefit from periods of instability, if not always from the initial shock – as investors shift from spending to saving and with a parallel ‘flight to safety’ in terms of markets and currencies, as well as a preference for secure international financial centres and providers. Advisory firms are generally nimble enough to adjust their models and propositions to align to short-term market conditions or shifts in demand; providers are not always able to move as quickly.

During the early stage of the COVID-19 pandemic, we feared that this shock would be different: international travel slowed, immigration in many markets stopped, and advisers struggled to deal with the effect of formal or informal lockdowns (in the context of highly analogue business models reliant on face-to-face contact and manual processes). However, by the second half of 2020 customer demand had re-bounded, benefiting those advisory firms that had transitioned to remote operations (as explored in Theme 2). There was even a silver lining from longer-term changes in expatriate and international retiree movements patterns: for example, retirees in Europe committing to local residency with implications for whole-of-wealth advice requirements.

BOD49 caused a substantial decline in UAE Insurance Authority (IA) volumes; however, this was materially offset by advisers rotating to the UAE Securities and Commodities Authority (ESCA) system and providers. In the broader international market, we are seeing increasing confidence that harmonisation of regulatory standards over the past 5 years (including measures within catchment markets and booking centres, notably the Isle of Man’s Conduct of Business regime) will reduce the scope or at least materiality of future regulatory shocks.

Advisory firms expect continuing positive momentum into 2022 and beyond (Exhibit 1), supported by improvements in productivity (enabled by the evolution of advice models during COVID-19) and expansion into new customer segments. Notably expatriate firms expect to expand their service offerings into international retirees and HNWs, and to provide a broader range of international services including real estate, residency and mobility support.

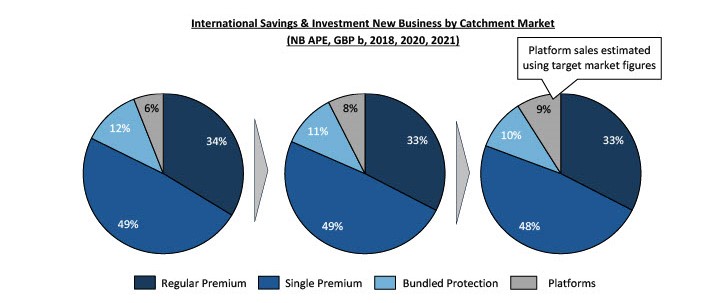

The rebound in sales was particularly evident in regular premium savings products (although they remained stable as a proportion of the total market) and at the lower end of single premium investment (including ‘smalls singles’ business written via platforms) and reflected an increase in savings activity in younger-age expatriate and local affluent segments (given limited scope to spend on travel or leisure). This pivot stabilised regular premium savings share of sales into 2021, ending the on-going decline in sales from 2018 – 2020, although single premium savings (ex- platforms) remains the larger category (Exhibit 2).

Bundled and protection sales have declined over the past 3 years, though we consider this a cyclical trend reflecting lower interest rates (in the case of universal life) as well as the impact of BOD49 on whole-of-life sales under the UAE IA jurisdiction. Mid- to long-term we continue to see scope for protection sales to grow (with a significant protection gap in expatriate and local affluent segments) and anticipate some level of rotation back to universal life over the mid-term (albeit primarily in the UHNW market).

Exhibit 2: New Business by Product Category (2018, 2020, 2021)

Source: NMG International Key Accounts Study 2018, 2020, 2021, NMG Cross-Border Market Model 2021

COVID-19 had a significant negative impact on advisory businesses in early 2020, with national lockdowns and reductions in international mobility (expatriate and other) challenging face-to-face advisory models and causing a lack of confidence around long-term savings and investment decisions. However, in the second half of 2020 and into 2021 we have seen advisory firms pivot to remote and digitally enabled models, with the leading firms moving to expand client panels and service scope (meaningfully lifting productivity).

Product providers (insurers and platforms) that have been investing to streamline and digitise services over several years (but reporting variable adoption or benefit realisation) have experienced an accelerated rotation from manual to digital over the past 18-months. Even the providers leading on digital/online capabilities have been challenged by transaction volumes and support demands (resulting in short-term declines in service citations, albeit with the prospect of longer-term gains). For those providers coming off average or below-average digital/online capability citations, the gap is now daunting – they face a significant investment and time horizon to build, and then the challenge of ‘dislodging’ advisory firms that have built into another provider’s digital ecosystem.

We see three key priorities for providers seeking to lead on digital/online citations:

Citations in our 2021 round point to emerging winners in respect of transaction automation and services albeit with even the top-rated providers having gaps to address, and with less strongly rated participants seeking to catch up. Platforms clearly lead overall, though based on a sub-set of citations (40%) and in specific segments (notably in Europe and the UAE). More broadly across all key accounts (including for regular premiums, for HNW single premium cases and for international acceptance), international insurers still dominate, and there the clear winners were ITA (leading on digital and distinguished on operational support) and RL360 (distinguished on digital and leading on operational support) with most other insurers ranked below average.

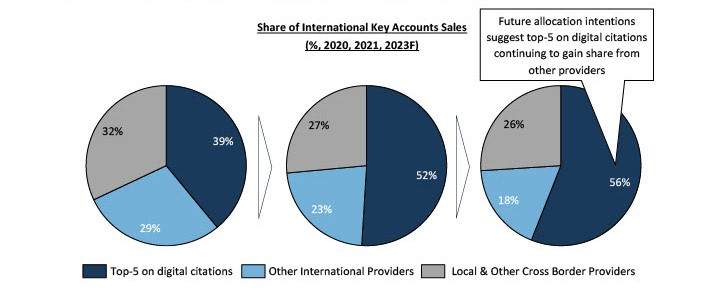

Leadership on transaction and automation is paramount as reflected in share (Exhibit 3), where the top-5 (the top-3 platforms, and RL360 and ITA amongst insurers) on digital citations are seeing continuing growth in share as well as strong unit cost outcomes. We see digital marketing and tools as the next battleground, and with an emphasis on investing with advice partners to drive revenue benefits as well as risk and efficiency gains.

Exhibit 3: Share of New Business by Provider Type (2020, 2021, 2023F)

Source: NMG International Key Accounts Study 2020, 2021

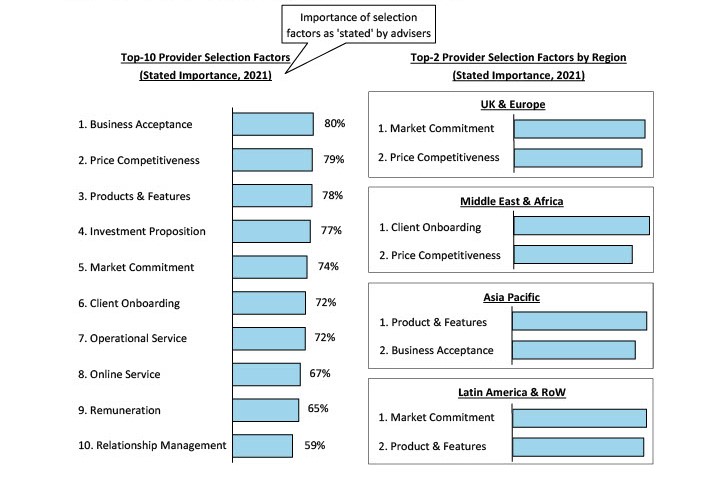

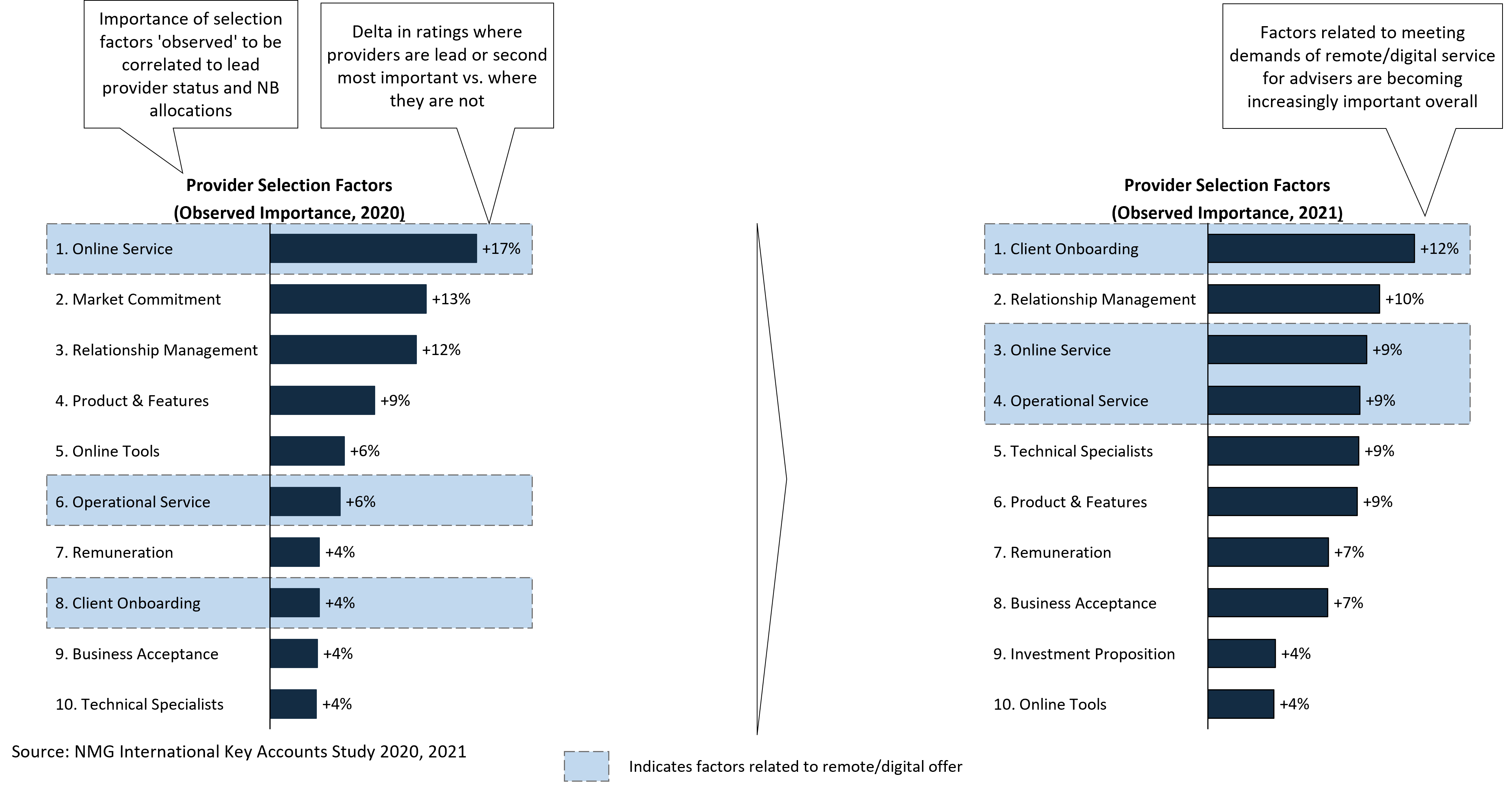

We have previously noted that international advisers cite business acceptance along with product and price as the most important factors, with the latter two being consistent with developed IFA markets around the world (Exhibit 4). Of course, stated preference varies by market, reflecting market conditions (competitive depth, client complexity and regulatory settings).

Exhibit 4: Key Success Factors (Stated) Overall & by Region (2021)

Source: NMG International Key Accounts Study 2021

These ‘stated’ factors are not the most highly correlated to provider allocations in practice (‘observed’ or correlated key factors, as per Exhibit 5). This is because while product/price are important as hygiene factors (a ticket to play), there will typically be several leading providers that are competitive on these.

Instead, allocation between these short-listed providers are based on other factors, notably client onboarding, relationship management and as of 2021 online and operational service factors (Exhibit 5).

Exhibit 5: Key Success Factors Correlated to Share of Wallet (2020 – 2021)

Source: NMG International Key Accounts Study 2020, 2021

While stated factors have been remarkably consistent over time, observed factors have changed markedly over the past 3-years. Online (digital) transaction capability has been cited as important for some time, but we note the increasing importance of client onboarding and operational support as more advisory firms have moved to drive more of their business online (and rewarded those providers best able to support this, in terms of operational as well as digital offers). Relationship management remains a key factor although the basis and format has changed, with greater emphasis on value-add including technical and practice development support. Meanwhile correlations for ‘market commitment’ have declined, suggesting that advisory firms are more confident in the commitment of their preferred partners (market commitment remains important, but is not currently a driver of differentiation between short-listed providers).

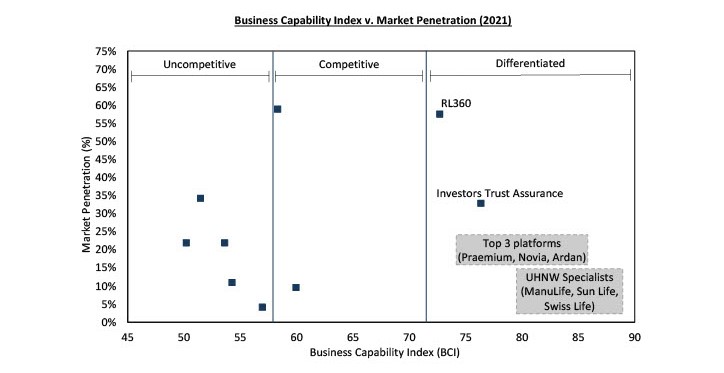

10 years ago, we predicted a long-term rotation from multinational-owned international life offices to independent specialist providers led by long-term industry executives and backed by private capital. We saw specialist providers as better able to manage risk/reward outcomes and drive volume and margin, in a highly dynamic and fragmented market. We have seen this rotation play out notably through M&A activity, with the sale of FPIL to IFGL, and Generali International and (most recently) Quilter to Utmost.

This has left only a handful of multinational-owned participants, and those have narrowed their focus to a handful of target markets/customer segments to overcome group-level concerns for the fragmentation and complexity of the international savings and investment market. Canada Life and Prudential International have strong franchises in the UK and Europe; Sun Life Bermuda and Manulife Bermuda in the UHNW segment; and notably the platforms Praemium, Novia and Ardan, in expat segments in the UAE and Europe. The continuing presence of multinational-owned participants suggests that challenging market dynamics are not insurmountable, at least in relation to the largest markets and segments.

Looking across the international market, RL360 and ITA are the clear leaders on capability citations (Exhibit 6), with a long-term track record in the international market and positive share of wallet outlook. While there is some level of overlap in RL360 and ITA’s target markets, each has significant and clearly-defined ‘core subsegments’ in which they lead.

Exhibit 6: Business Capability Index v. Market Penetration (2021)

Source: NMG International Key Accounts Study 2021

However, what is perhaps more interesting, will not be immediately visible in our 2021 results. We had also expected to see a new crop of niche challengers emerge as multinationals withdrew, including distributor-backed providers and start-ups emerging to challenge the incumbent specialists. In practice (and excepting platforms), new entrants have underwhelmed in terms of both penetration and adviser citations. This suggests that barriers to entry have materially increased, not least as a function of the evolution of the regulatory landscape and increasing emphasis on digital and operational service factors. It is no surprise then, that we see private capital favouring those established, at-scale providers with strong franchises and capability citations (as opposed to niche or fringe players).

The respondents to our 2021 interview round (IFAs, brokers and banks) were markedly more positive in their expectations of the future, as compared to prior years. However, we would highlight that this is reflective of the top-end of the advisory market (whether global or regional, broad or niche). Across the sample there is an expectation that aggregate adviser numbers in the international market will continue to decline as a function of exits at the tail-end of the market, partially offsetting strong expected growth in client coverage, service scope and productivity at the top-end.

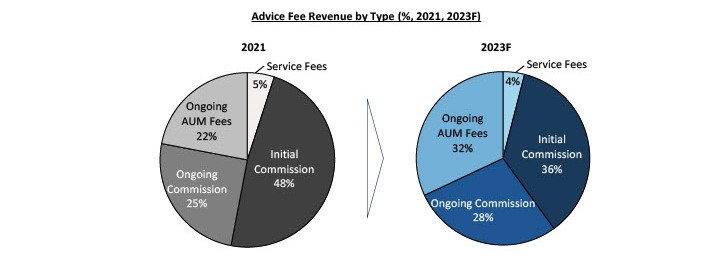

At the top-end of the advisory market, we anticipate:

Exhibit 7: Advice Fee Revenue by Type & Region (2021)

Source: NMG International Key Accounts Study 2021

Of course, the transition to more efficient/higher value models requires a significant investment, in terms of management time as well as capital (and with the potential to be compounded by more onerous capital requirements on advisory firms, as currently under discussion in the UAE).

Traditionally, demand for capital has driven advisory firms into vertically integrated models. Providers would buy into independent advice businesses to drive uptake of their own products and in return, would offer advisers a range of benefits, including access to capital, regulatory support and access to leads (as seen in the UK immediately post-RDR).

However, the feedback from top-end international advisory firms is that provider participation is not required in their businesses. They are increasingly confident in generating new business through a period of constant regulatory and economic change, and in driving the shift to digital and remote models. Furthermore, with growing interest from private equity firms in the international savings and investments market, advisers feel they have a choice of capital partners.

What we do see is growing appetite among advice executives to establish commercial partnerships with best-in-class providers (insurers, platforms, technology vendors and DFMs; as well as banks and other origination partners) to white-label or otherwise increment the cost of developing ‘bespoke’ solutions. In parallel, we expect to see increasing ‘capitalisation’ of international advisory businesses, with a continuing shift to larger, more ‘corporatised’ and formally capital-backed distributors (a trend that we have already seen play out in the UK advice market).

While even the leading international advisory firms would admit that there is still a long way to go, we are optimistic about the future (particularly for the top-end of the market), given the level of progress with transformation over the past 2 years: from face-to-face to remote, from manual to digital, and in terms of the diversification of revenue models both within traditional financial services and beyond.

Ashwin Field, Global Partner based in Sydney ([email protected])

Charles Lake, Partner based in London ([email protected])

Anton Kladnig, Consultant based in Sydney ([email protected])