November 5, 2020

APRA performance test: consolidation by stealth

It has been difficult to miss APRA’s frustration at the lack of consolidation amongst super funds. The…

“Never let a crisis go to waste.” President Obama’s Chief of Staff, Rahm Emanuel, repopularised Churchill’s quote during the GFC. Some asset management firms are doing just that by ignoring the opportunity to reshape distribution models in the wake of COVID. It’s a mistake that could cost them money, time and chance to lock in growth.

In asset management, distribution teams are often shielded from organization-wide cost-out programs. Leadership teams are generally reluctant to reduce the breadth or depth of the very team that engages with the outside world and risk missing out on future opportunities or – worse – losing existing clients.

That isn’t to say sales teams aren’t constantly battered with questions as to how productive they are, how much value they really produce and whether their selling strategy is still right for the modern age.

Coming into COVID our hypothesis was that distribution models could change – for the better. Face-to-face contact has long been the model but remote working meant it was no longer possible. And whilst we’ve seen several firms try remote sales/service models in the past, we haven’t seen major success stories. In our view the old ways – established work patterns, existing skillsets – were too entrenched.

Has COVID-19 changed distribution?

It needed a crisis to break these patterns. So, we were interested to find out how advisers reacted now that COVID – not asset managers or platform providers – was forcing the change on them. Our Adviser Pulse research threw up some interesting answers which – combined with research conducted as part of our Global Asset Management research – showed:

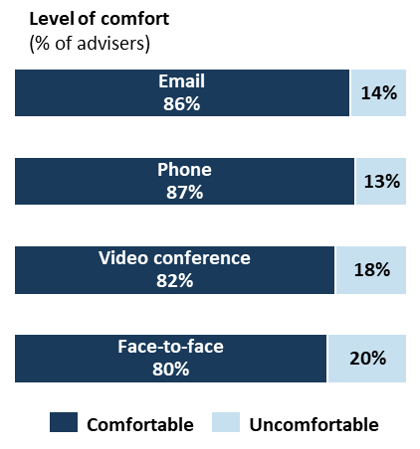

When we look specifically at mode of communication, we find that advisers are now as comfortable in a videoconference as they are face to face (see chart below). Most advisers were happy with content and the ease of video conferencing – getting the duration of the conference right was a big driver of satisfaction. So changing the way the industry interacts with advisers isn’t just about what works for asset managers – it’s about being responsive to advisers’ needs.

Harvesting the efficiency dividend

In our view these results proves that the move to more and better digital-based distribution will work if you get the model right and manage the change well. That means there is an efficiency dividend to be harvested if asset managers act now to develop a new sales/service model that relies heavily (but not exclusively) on remote interactions.

In our view this efficiency dividend is significant – potentially worth up to 20% of the distribution function cost profile.

Over and above optimising digital interactions and the digital/face to face mix, asset managers now need to decide how to deploy the efficiency dividend they’ve been gifted.

Do they:

Who shares, wins

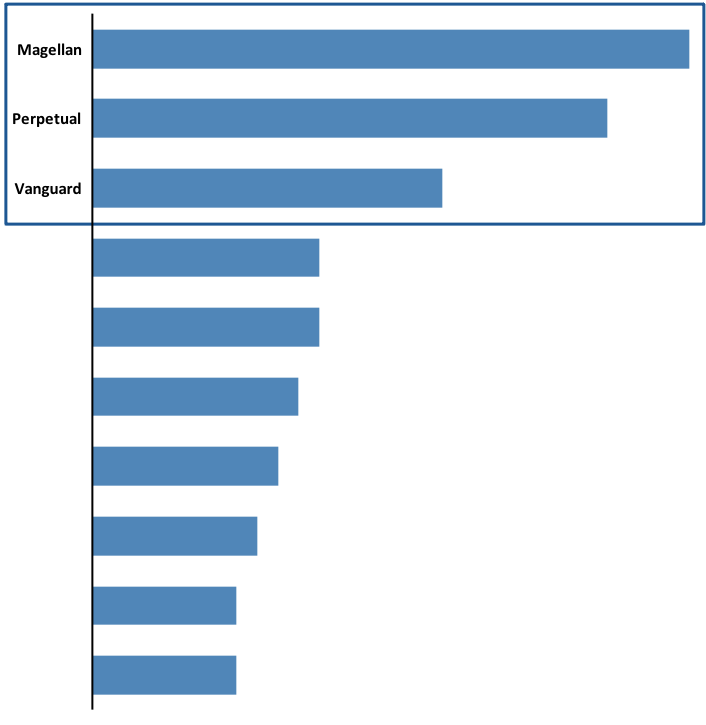

When asked who delivered the strongest support during the COVID-19 crisis, Magellan and Perpetual were clearly at the top of adviser rankings with Vanguard in third place. What drove those rankings? Frequent, high-quality market, product and portfolio manager comms.

Initiative versus inertia

The right answer will be different for each firm. The NMG view is that intelligent, bespoke analysis can underpin the right decision. But that decision needs to be made fast – lest the dividend evaporates as distribution teams drift back to old ways.

Anecdotally, we’ve heard of sales teams in (effectively COVID-free) Western Australia booking plane tickets for their next face-to-face client visit. There are always exceptions, but for most businesses, that approach is the very definition of ‘wasting a crisis’.