July 4, 2023

Traditional asset managers well placed to gain from retail shift to alternatives

Specialist alternatives managers have taken the lion’s share of alternatives inflows and enjoyed the associated high margins,...

The Voluntary Benefits insurance segment in the US has emerged as a global benchmark for providing scalable solutions tailored to the middle market.

In 2023, new sales of employee-paid insurances surged to USD 9.34 billion, marking a significant increase of 6.7%. This milestone represents a new high-water mark for the segment, signifying a definitive departure from the pandemic era.

Term Life insurance continues to dominate, constituting approximately 20% of total new sales. It has also shown robust growth, expanding by 10% in recent evaluations.

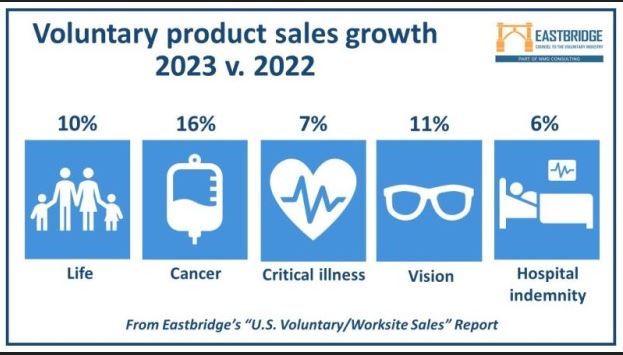

Exhibit 1: The Voluntary Benefits segment in the US

% of Voluntary product sales growth , 2023 vs 2022

The Voluntary Benefits segment in the US is thriving, driven by positive demand tailwinds. This growth underscores the sector’s resilience and the increasing momentum of the ‘worksite’ distribution channel within the US market.

The success of Voluntary Benefits in the US also underscores its potential as a powerful distribution model in various global markets, highlighting opportunities for expansion and adaptation.