September 13, 2022

A future industry structure

Advice propositions today are largely based on providing consumers with comprehensive advice (considering a wide range of...

Industry funds’ dominance of Australia’s retirement system is widely acknowledged, though their infiltration of the HNW segment has stayed largely under the radar. This poses new challenges for retail competitors.

From its inception, the competitive landscape in superannuation has observed a largely comfortable delineation, with industry and retail funds ‘rising with the tide’ in service of a large and growing asset (and customer) pool.

Members with lower balances were almost universally found in employer-default products, the core proposition of industry funds. In contrast, and somewhat symbiotically, retail funds dominated the HNW and advised segments. In this paradigm, industry funds effectively acted as incubators for retail funds.

A long-held view within the retail super and advice industries has been that clients with higher balances have inherently more complex needs, these being better served by the more sophisticated product offerings of retail competitors.

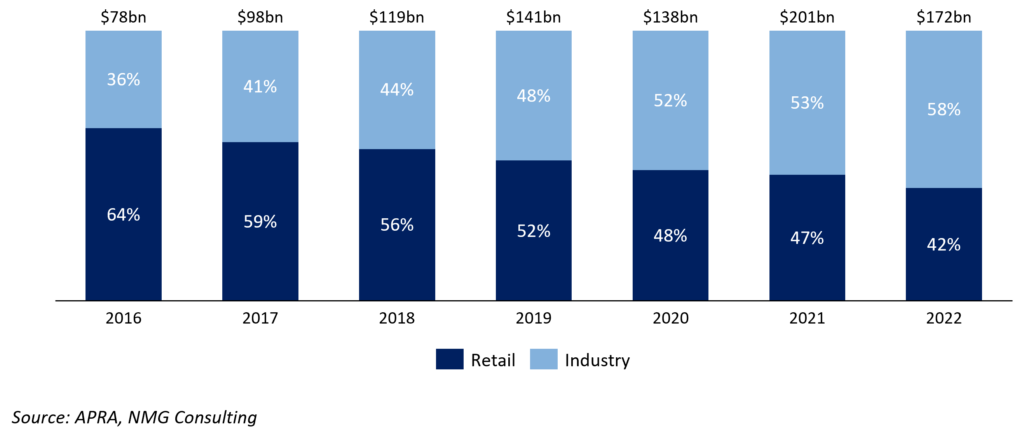

However, the combined effects of the Royal Commission and the on-going war on underperforming superannuation funds are steadily erasing traditional competitive boundaries and norms. One highly notable example is that industry funds now dominate the HNW superannuation member segment, their share of AUM in superannuation rising to 58% (from 36%) in just six years.

Exhibit 1: Industry funds approach two-thirds of HNW AUM

Total assets in >A$1m Super and Pension accounts by fund type 2016 – 2022

That fact that industry funds have made such significant advances in the HNW segment absent meaningful product development or service differentiation, challenges – if not entirely overturns –the idea that high-balance customers are better in retail funds.

Any further inroads into the HNW segment by Industry Funds could potentially pose new threats to the competitive positioning of retail platforms.

Already, there are reasonable expectations for why the market share of retail funds could be expected to trend lower:

Left unaddressed, the retail platform industry could find itself on a slow march toward the margins, focused on non-super assets and members with only the most complex of advice needs. While this would remain an attractive market for some, it would unlikely be sufficient to sustain the current number of retail platforms or participants.

Retail platforms need to double down on what they do best, expertly servicing the evolving needs of advisers, while regularly re-evaluating product ranges, cost bases and core value propositions to hold up in an increasingly competitive environment.

Furthermore, the Government’s response to QAR shows positive intent toward lifting the supply of advice in Australia. Retail funds need to carefully consider – and then advocate for – policy positioning and be prepared to capitalise on opportunities when presented.

At NMG’s upcoming annual client strategy event we will discuss the implications of QAR in terms of the emerging advice spectrum and where the opportunities sit across the industry. Reach out if you would like to hear more from us.