April 24, 2023

Active’s silver lining

On an outlook of healthy contestable flows, plenty of opportunity exists for well-positioned retail equity managers in...

Large active managers have struggled to maintain pace with passive and niche-active providers in recent years. With a particularly difficult year drawing to an end, what will drive the competitive outlook over the next five years?

This has been a particularly trying year for retail asset managers in Australia. The June quarter saw the largest net outflows of any quarter in the past 30 years, and CY23 is expected to be one of the worst on record.

Of course, the pain has not been felt evenly. There have been clear structural and competitive drivers of success (or otherwise) over the past five years. And with the year now coming to an end, managers should be thinking about how to position for success over the next five.

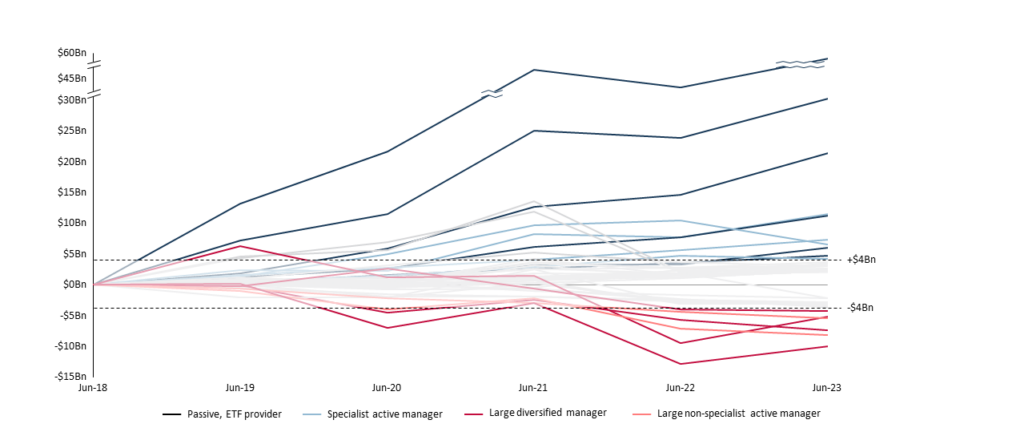

Exhibit 1: Total growth in retail AUM by manager, 2018 – 2023

Source: NMG Consulting, Morningstar

Note: Normalised for M&A activity, excluded Capital Guaranteed and MySuper funds as well as those with absolute FUM change <+/-$2bn

The standout feature of the past five years has been the extraordinary growth of passive managers. The top three passive managers account for over half of the total retail system growth over the period.

“Top three passive managers account for over half of the total retail system growth over the past five years.”

The passive sector has benefited from the growing popularity of ETFs in the direct channel, and deliberate rotation toward passive in the advice channel.

The second major driver of success over the last five years has been specialist and niche capabilities. The success of these managers over recent years is a result of the increasing sophistication of the advice market and the growing popularity of the core / satellite approach to portfolio construction.

Large diversified and non-specialist active managers have fared the worst in recent years, bearing the brunt of the rotation away from legacy master trust platforms (toward contemporary wraps and industry funds).

There are two key trends emerging which will drive competition in the retail asset management market over the medium term:

1.Growth in passive to slow

The direct market, having fuelled a large portion of passive growth in recent years (via ETFs), will cool under economic pressures. Higher-for-longer interest rates, high levels of indebtedness and a weaker market outlook will limit discretionary investing.

The rotation to passive among retail advisers has also mostly run its course. The retail advice market has a long-term passive target of 33%1, and the advised market is currently at ~30%2 passive. In a lower growth environment, many advisers will also be looking for more alpha in their portfolios.

This will likely result in passive growth slowing by approximately half over the next five years, compared to the 33% pa it has seen over the past five years. This remains an extraordinary growth rate in a reasonably mature market.

2.Advice sophistication & consolidation

The Australian advice market has and will continue to become more sophisticated. It is also likely that the advice industry will (re)consolidate, as advisers look for operational efficiencies and to share compliance costs.

These larger and more sophisticated firms will exhibit buying and allocation behaviour increasingly akin to that of an institutional rather than a retail investor, supported by the growing popularity of managed accounts.

This behavioural shift will see the average advised portfolio contain more alternatives, express a more nuanced view on sub-asset class exposures, be more sensitive to esoteric risk factors (duration, currency, ESG, etc), and be more sensitive to the alpha generated by their fee-intensive allocations.

Passive managers will continue to see strong net inflows via both the direct and retail channels, though likely not at the levels seen in recent years.

The switching out of retail active funds will slow down and could see the retail managed fund market return to a positive net flow position over the next 5 years.

Fee compression will continue to impact all areas of the market as competition intensifies. This will likely be most heavily felt in core active exposures.

Fee compression within the ETF market could soon see ETFs priced at a level that attracts meaningful institutional take up. This would drive significant growth in the ETF sector but would only be contestable for a handful of passive managers – and the economics would not be particularly enviable.

The conditions that saw specialist and niche managers succeed over the last five years will persist, those with demonstrated capabilities in unlisted assets, where retail is significantly underweight when compared with the institutional sector, are particularly well placed.

For the large incumbent managers, the question remains; how to leverage a dominant market position into a dominant (long-term) competitive position?

Australia is a stock market, and stock markets favour incumbency. Managers need to use the runway they have to build the capabilities they will need over the next decade. They need to assess their product suite in line with the evolving needs of the market and be realistic about the long-term prospects of large back-books (and invest accordingly).