January 21, 2025

Bridging the pensions expectation gap

How are current support services for pensions under-delivering on what consumers really want and expect – and...

The first in a series examining implications of pension market consolidation.

As the UK government finalises mechanisms to encourage pension fund consolidation, Australia’s decade-long experience offers timely insights for funds facing strategic choices about their future. While the push for consolidation centres on creating larger, more efficient funds, a fundamental question remains: what truly constitutes better outcomes for pension members? The Australian journey provides valuable lessons on this critical question.

Underpinning the UK Government’s policy to encourage fewer, larger UK DC and local government UK pension “mega-funds” is the desire to:

However, the Australian experience suggests achieving these objectives is more nuanced than it appears.

It is unclear how the UK Government plans to force funds to deploy member capital toward nation building – or, frankly, whether it should. With the fiduciary duty of funds to their members, and absent financial incentive (tax breaks), the Government has neither stick, nor carrot.

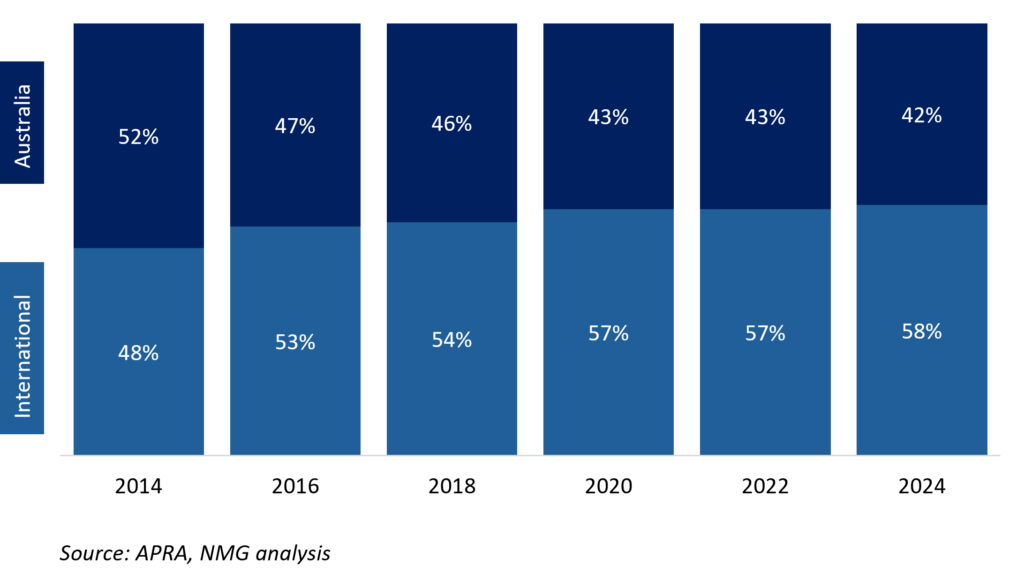

The experience of Australia’s DC superannuation funds – often viewed as exemplars – is instructive. The Australian market has a substantial tax advantage for local investors into domestic equities, acting as a significant incentive for portfolio home bias. Whilst this historically resulted in an overweight allocation of DC funds to domestic equities, the need to diversify portfolios has increasingly become evident and there has been an unwinding of historical home bias at the same time that funds have been consolidating.

Exhibit 1: Australian not-for-profit super fund listed equity allocations – domestic vs international

% of listed equity portfolio, end-June 2014 – 2024

We have not seen any strong evidence that consolidation will drive greater allocation to domestic assets in the UK, and the Australian experience certainly does not provide confirmatory support either.

The theoretical benefits of scale are compelling and widely accepted. Larger funds can leverage greater buying power to reduce costs, access broader investment opportunities which smaller funds cannot, invest in internal capabilities across the value chain, and create operating leverage through fixed cost dispersion. However, Australia’s consolidation experience highlights two challenges. First, funds require significant impetus in order to ‘give up’ and be merged into a larger organisation. Second, realising post-merger benefits is more challenging than anticipated.

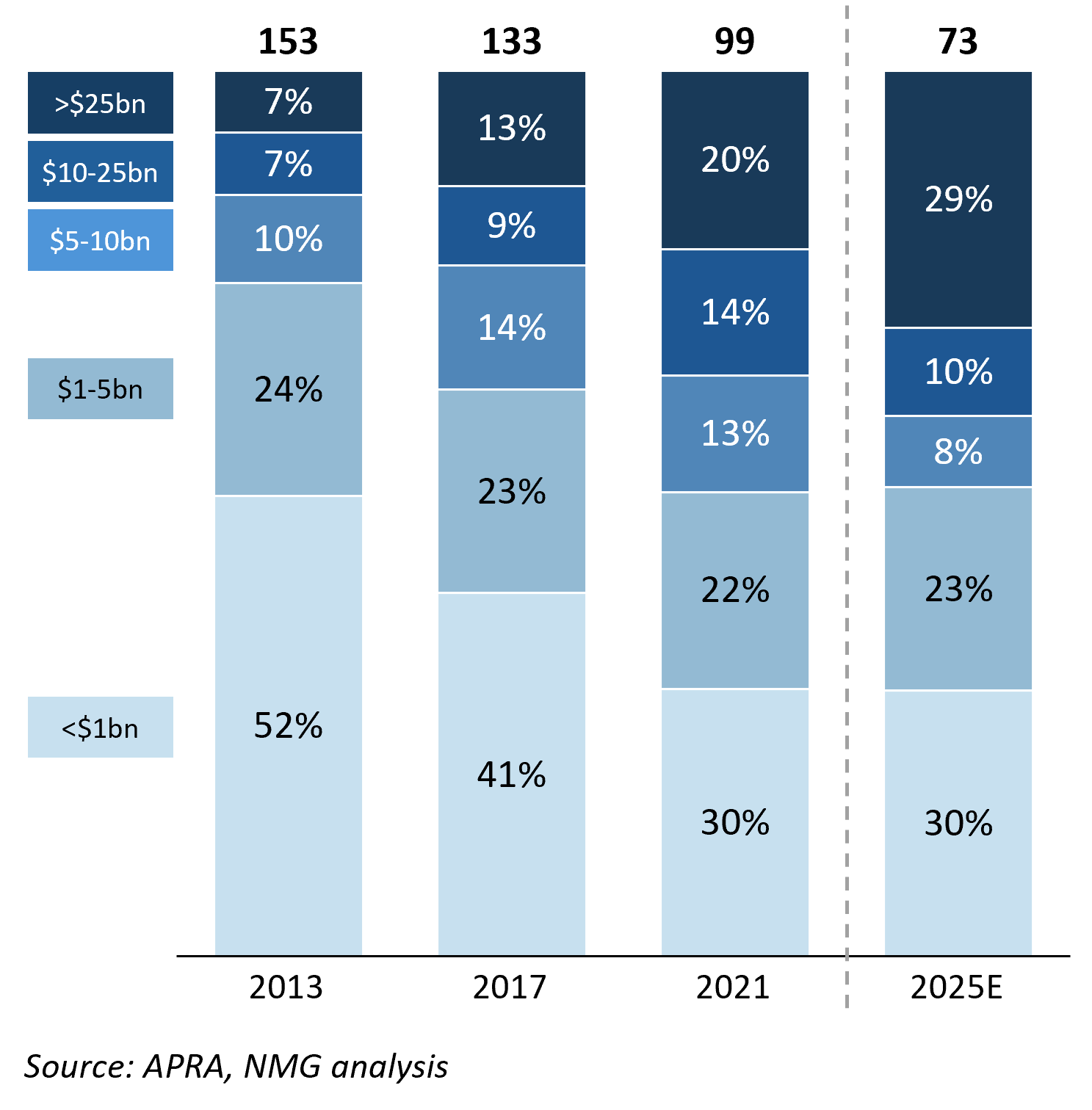

Australia’s DC pension market has been on a path to organic consolidation for years (Exhibit 2), with default participation and preferential placement driving significant flows to a few not-for-profit funds (which, it has to be said, mostly did a very good job in looking after their members’ retirement savings). However, there remained a relatively long tail of funds with <A$25bn, and even <A$10bn right up to the early 2020’s, some 30 years after the system was created.

The introduction of the “Your Future Your Super” Performance Test1 in 2021 – devised in part to speed up the consolidation by weeding out funds with poor performance – has in fact accelerated matters. In short, the regulator published fund performance against benchmarks for all workplace DC funds and prevented those who failed from continuing to take in new members. Of course, this had the (very much intended) effect of forcing underperforming funds to merge.

Combined with heightened regulatory supervision and oversight dramatically increasing compliance costs (adding further pressure on smaller funds), this has driven rapid consolidation – with large funds (>AUD$25bn) now representing ~90% of pension assets.

Exhibit 2: Total number of funds by AUM bracket

A$, 2013-2025E

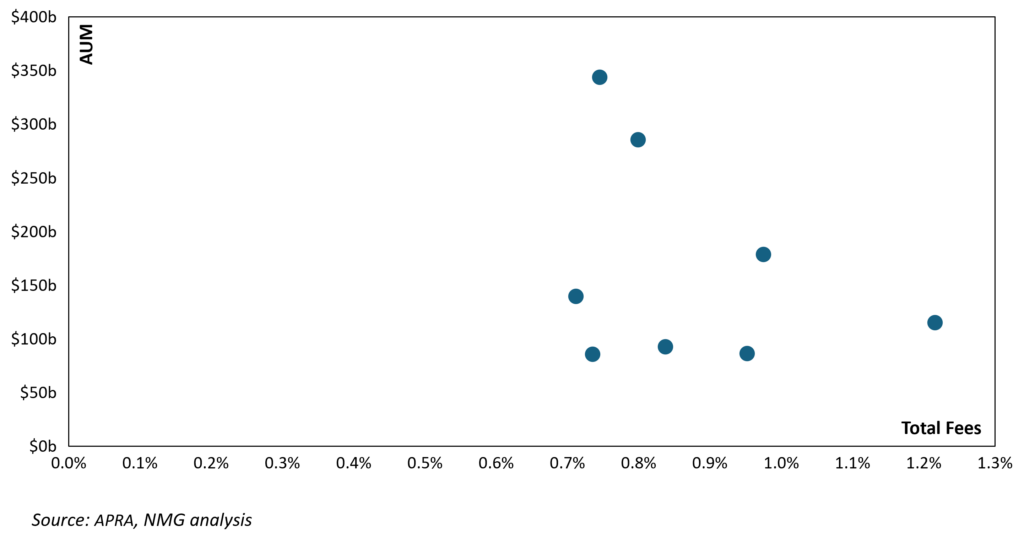

The idea of fewer, larger funds is supported by strong logic. However, empirical evidence on scale benefits accruing to members is – at best – mixed (and covered in detail, elsewhere). Members may benefit from being part of a larger fund in many ways, such as the associated increased investment in member service capabilities, but analysis of Australia’s largest funds shows administrative costs have often remained flat or even increased.

Exhibit 3: Fund AUM vs Fees

MySuper, A$50k balance, June-24

Operational costs are heavily influenced by member demographics and strategic choices around investment capabilities. Moreover, funds with different operating models – from fully outsourced to highly internalised – can deliver similar member outcomes through different paths. So what we see is that smaller funds often – by necessity – pursue alternative operating models or ways of working in order to reduce costs.

One other observation is that the largest funds face dramatically higher regulatory scrutiny and associated costs, which only increase as funds merge. Furthermore, mergers can introduce a degree of operational complexity that flows through to integration costs. This in part explains why member fees have not consistently declined with scale from mergers.

Australia’s experience with superannuation consolidation offers important lessons for pension funds considering mergers and acquisitions. While consolidation can deliver benefits of scale, success requires careful navigation of three critical areas: demographics, operating model design, and governance capabilities.

Demographics and operating models have proven critical to successful pension consolidation in Australia. Most operational costs are member-driven while revenue is asset-based, with members typically not becoming profitable until their mid-30s. This creates important demographic considerations for merger decisions beyond simple scale metrics.

While many Australian funds used scale to build internal capabilities, the most successful maintained strict strategic discipline. Keeping core operations simple, selectively insourcing to drive strategic advantage and member benefit, and outsourcing non-core functions. They also used scale primarily to drive better outcomes from external providers and focused on strong counterparty risk management.

Governance structures often struggled to keep pace with growth in assets and operational complexity. Successful funds invested early in robust investment governance frameworks, enhanced risk management capabilities, and professional board composition.

For DC providers, preparing now is essential. If the Government does use the proposed scale threshold as the consolidation trigger, the more attractive targets will likely be merged quickly. Funds best positioned to shape consolidation outcomes will be early movers with a clearly defined strategic position, target operating model and who can quickly identify compatible partners. Having the right criteria in place now is vital.

UK pension funds face a defining period of transformation. Those that proactively address their strategic positioning while maintaining focus on long-term net performance will be best placed to shape their future role in a consolidated market.

Australia’s experience shows consolidation is a means to improve member outcomes, not an end in itself. Success requires careful strategic positioning, disciplined execution, and a member-first focus.

NMG Consulting brings deep expertise in pension fund transformation and outcomes for participants. Contact our team for more detail.