November 17, 2020

Doubling down on successful partnerships

The insurance industry in South Africa is doing its part in responding to a 1-in-100-year global event….

That institutional customers would look for long-term relationships with ‘good partners’ is both intuitive and uncontroversial: broadly, and across industries. Less well appreciated perhaps is that core to successful long-term partnerships is a well-formulated, effectively communicated strategy.

Strategic clarity comprises two primary elements, the core strategic intent and then how well it is communicated.

A coherent corporate strategic intent must necessarily:

Communication to external stakeholders needs to be appropriately articulated and disseminated.

And yet for all that, talk is cheap, as the views of customers (and gatekeepers) will ultimately be formed by how the strategic intent manifests in behaviour, meaning that:

The Property & Casualty reinsurance segments serves as a good case study.

The industry adage that “reinsurers are in the business of taking risk” underlines the obvious importance of demonstrated high levels of healthy risk appetite.

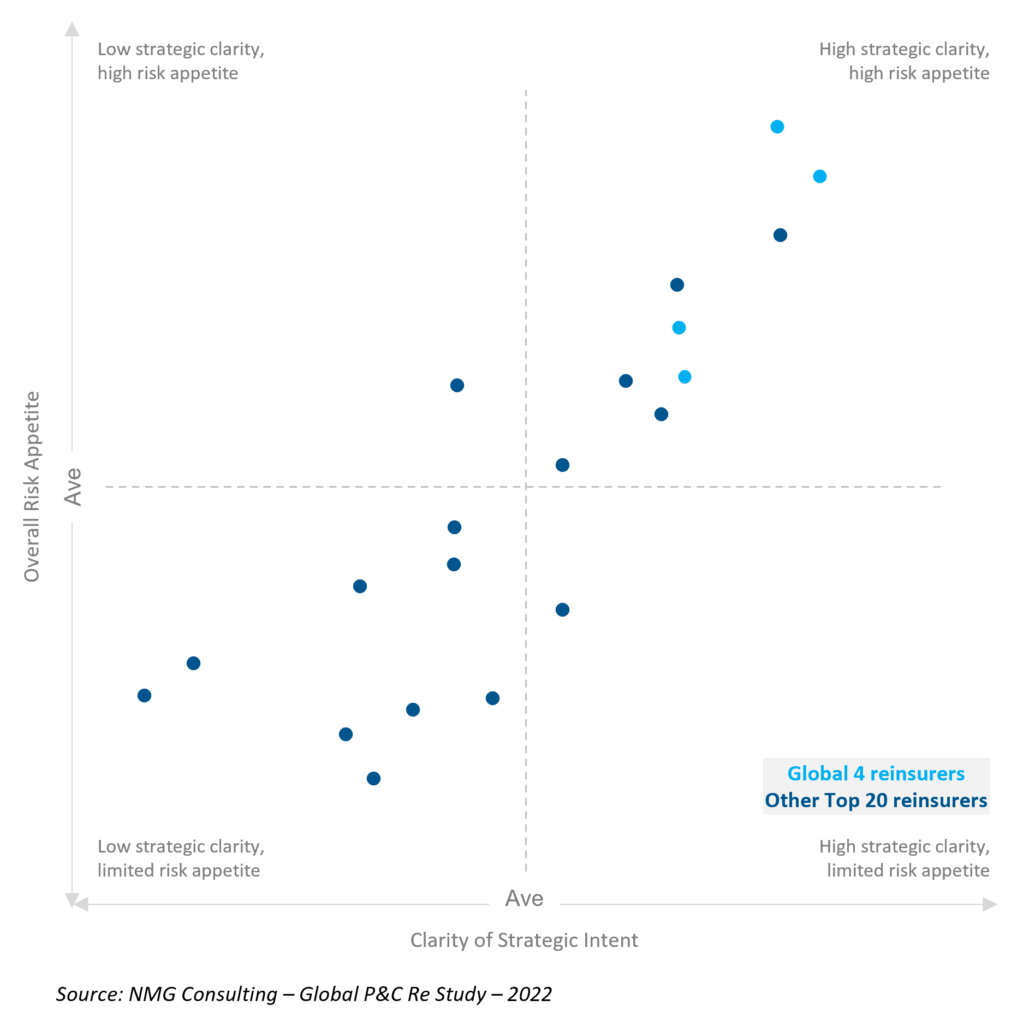

Exhibit 1: Clear strategy and healthy risk appetite are stablemates

Exhibit 1 illustrates that, for the P&C segments, perceptions of the clarity and coherence of reinsurer strategies correlate positively with perceptions of their risk appetites:

Given the importance of risk appetite, regardless of the causative processes or indirect linkages, reinsurers need to perform well on both dimensions to be competitive.

It goes further than that, however.

‘Good partners’ adopt a collaborative approach to problem solving, as well as being consistently transparent and trustworthy. They also have a strategic, long-term view of the client relationship.

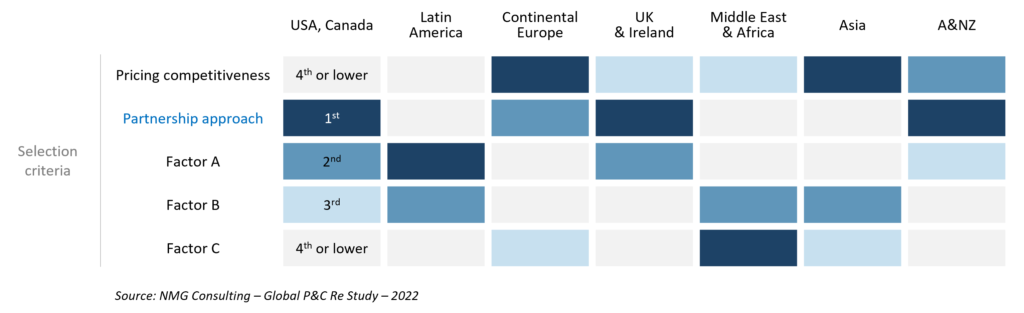

Exhibit 2: Partnership approach is a leading factor reinsurer in selection

Insurer rating of selection factor importance by region

Price and value factors both count materially to reinsurance partner selection as well as the effectiveness and sustainability of operational engagements. Exhibit 2 highlights how partnership effectiveness ranks above price competitiveness for insurers in many key regions including the US & Canada (the largest), the UK (which includes the Lloyd’s market), and Australia & New Zealand.

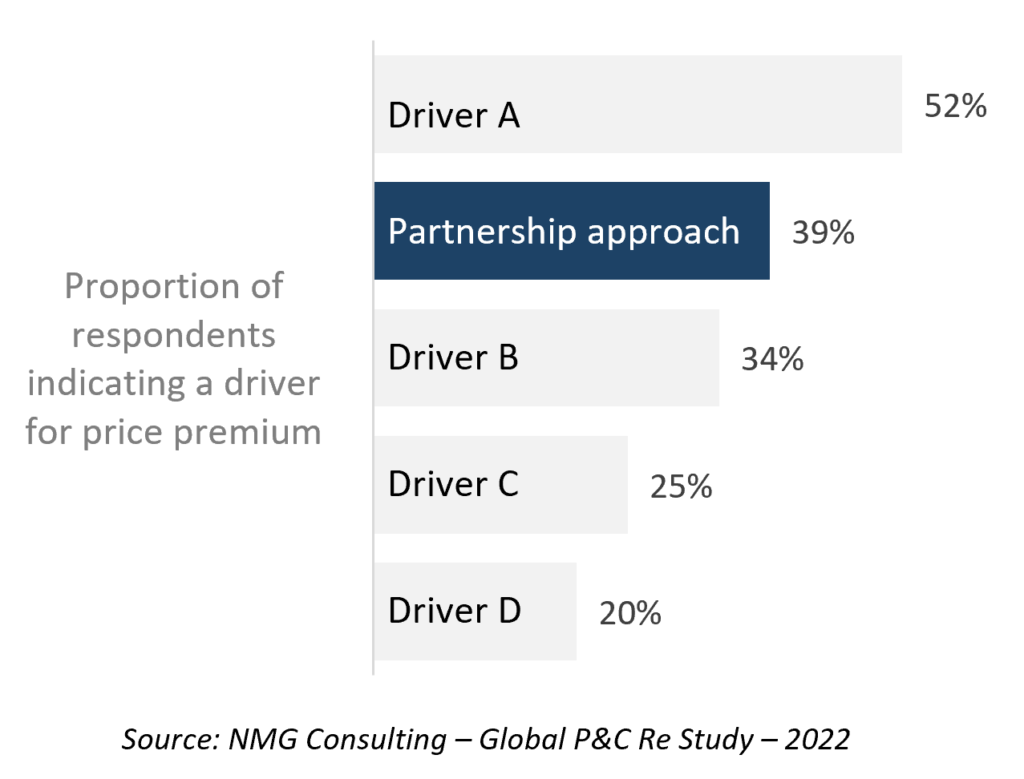

Exhibit 3: Good partners have more pricing power

Beyond reinsurer selection, in a market known for its price competitiveness, insurers consistently indicate a willingness to pay a higher price for reinsurers that are good partners.

This is especially the case when reinsurers have demonstrated their partnership approach by ‘walking the talk’ over an extended period. Insurer’s long memories recognise that partnering credentials are best examined under pressure and at the margin.

Incumbent reinsurers of long-standing are thus ultimately rewarded with some pricing power, for those able to play the long game. Absent a track record with a potential new client, reinsurers need to be persuasive that good partnership lies at the heart of their strategic intent and preferably be able to reference other cases in support – another insight into the link between the two.

Feedback from insurers and reinsurance brokers point to a clear link between partnership and clarity of strategy. The causative linkages are intuitive:

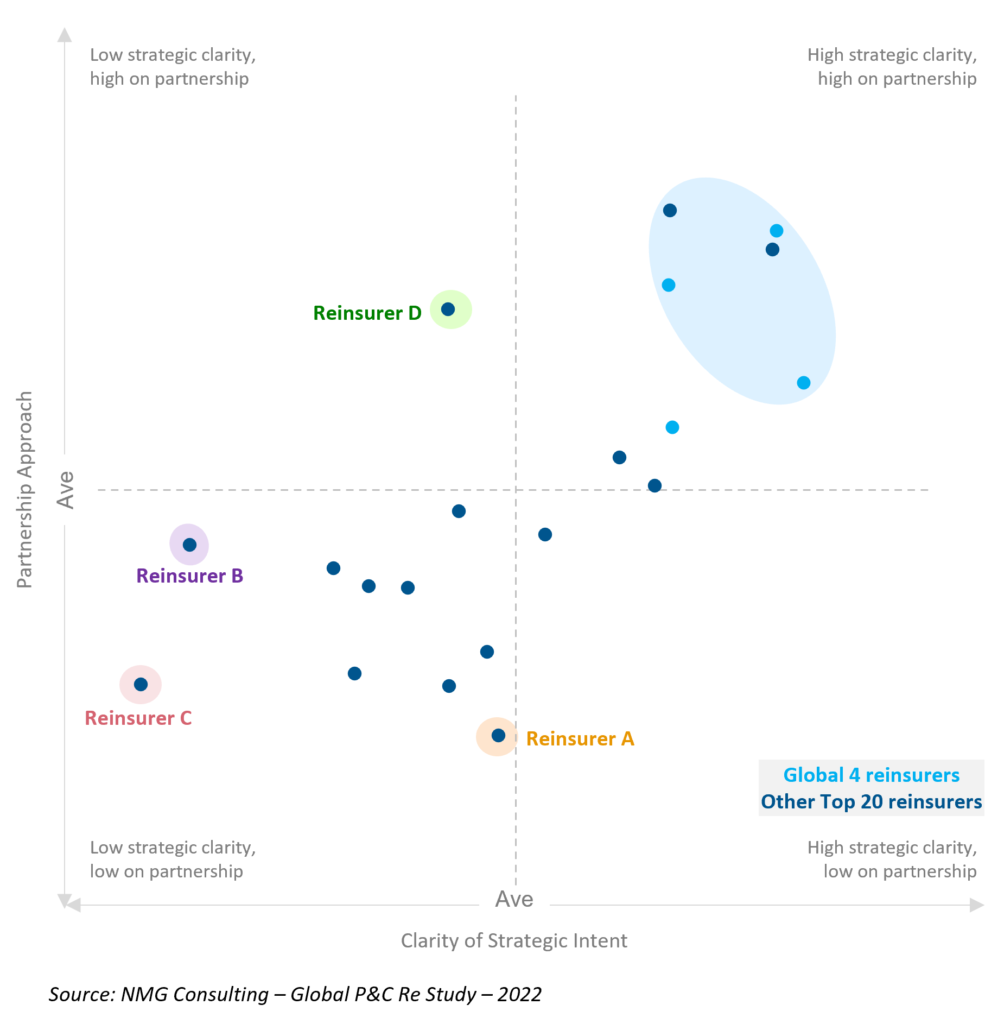

Exhibit 4: Clear about strategy, good in partnership

Leading 20 P&C reinsurers (globally); ratings from insurers for strategic clarity versus partnership approach

Five reinsurers rate well above average on both dimensions, including three of the four largest global players. A closer look at the outliers that score less well reveals more about the underlying context and drivers:

Companies regularly review their strategies, mostly by way of internal processes. The systemic incorporation of client and gatekeeper perspectives into strategy reduces the risk of blind spots and echo chambers. Signals should be drawn from broad-based inputs, and not limited those from core clients only.

Failure to do so, forgoes the opportunity to incorporate signals from external stakeholders about the ‘real world’ quality and fit of the current strategy, limiting the extent to which the process can be ‘self-correcting’ and adaptive.